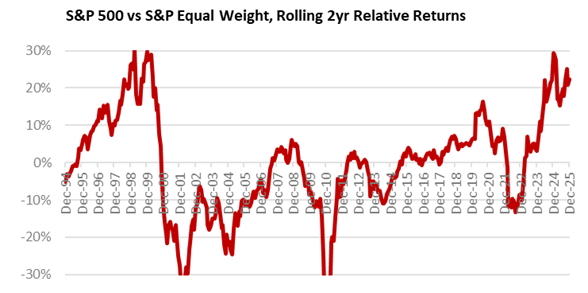

The concentrated market has been well documented and remains a prominent feature in stock returns. Chart 1 below shows the rolling relative returns of the S&P 500 (which is weighted by market cap) and the S&P 500 Equalweight (where each member has a 0.2% weight). S&P 500 rolling 2-year returns have been higher since March 2023, or for nearly three years, the longest such period since a five-year stretch from 1994 to 1999, and the gap has been over 20% for most of 2025, rivaled only by 1998 to 2000.

Chart 1

This highly concentrated market is the result of a narrow group of stocks driving market returns. For 2025, the S&P 500’s 16% outperformed the S&P EW’s 9% by 7%, following 12% outperformance in both 2024 and 2023. These three years are the largest calendar year S&P vs EW outperformance since 1999’s 9% and 1998’s 16%.

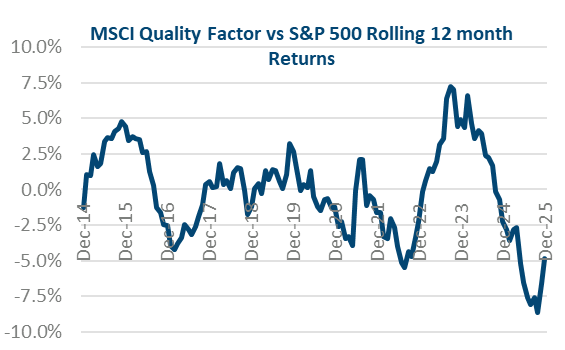

Along with the concentrated market, another factor has emerged in 2025: Quality has lagged by a record amount. For stocks, “Quality” represents stocks with better balance sheets, above average return on capital, and strong cash flow generation. Chart 2 below shows the relative 1yr returns of the MSCI Sector Neutral Quality Index ETF (QUAL), a good proxy for “Quality” stocks. On a rolling 1yr basis, QUAL lagged the S&P 500 by a record 9% as of October. This is the largest gap in the 10-year history of the ETF, as well as the prior decade of the underlying index.

Chart 2

For calendar 2025, QUAL returned 11.5% versus 16.4% for the S&P 500, lagging by 4.9%, which is the largest calendar year gap since the ETF’s inception in 2014.

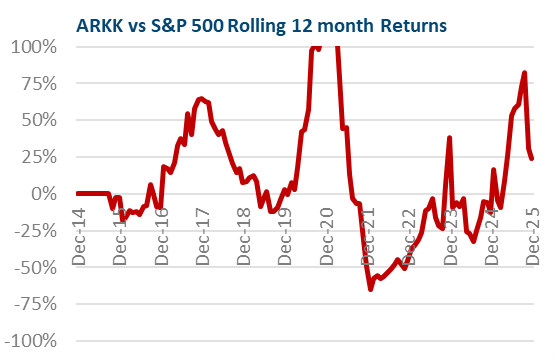

Heading in the opposite direction, speculative stocks have outperformed. Using the ARK Innovation Fund (ARKK) as a proxy for speculative stocks that are currently not profitable (ARKK’s current portfolio holdings have an aggregate forward PE of negative 96), a similar relative 1yr rolling return analysis shows a +80% relative return as of the end of October. In other words, exactly as the QUAL stocks were having their worst relative performance, the ARKK stocks were having their best run since Covid 5 yrs ago.

Chart 3

The concentrated market reflects the strong performance of the Mag 7 stocks, which have built strong cash generative businesses across the cloud-based technology and communications sectors that were, first, boosted by work-from-home policies during Covid and, just when that was fading, were supercharged by the advent of AI tools, services and buildouts starting in 2023. Yet despite this “high flying” reputation, the Mag 7 generally meet most definitions of Quality. The market concentration issue is one of index weights and portfolio construction, not of business analysis. The Mag 7 stocks themselves have durable, cash generating businesses that have allowed them to internally fund their growth, including the recent surge in AI capex.

Despite these Quality features, the markets have instead aggressively sought out either the next major AI play, or the next major technology. The irony is these new plays mostly lack the high-quality features that characterize the Mag 7’s businesses. Instead, they seek to emulate the other feature of these stocks: their high valuations and ramping capex plans based on hoped- for future products and services. Yet many of these stocks lack the ability to internally fund growth due to negative free cash flow (and sometimes minimal revenues) and thus are funded by debt and other external sources of capital. Negative free cash flow and the balance sheet implications of debt funded growth are the antithesis of Quality.

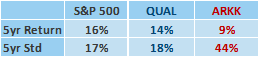

The risk inherent in lower quality stocks is evident in the five-year performance of QUAL and ARKK relative to the S&P 500. Even though this period included both the 2020 Covid rally and the 2025 rally, as the table shows, ARKK has overall had a challenging period. Not only has its return lagged, at 9% per year versus 16% for the S&P 500 and 14% for QUAL, but risk has been significantly higher, with annualized standard deviation of 44%, more than twice the readings for the S&P 500 (17%) and QUAL (18%).

Chart 4

When we talk about business cycles transitioning from growth to bubble phases, one of the keys is the shift from internally to externally funded growth. Externally funded growth allows for a rapid buildout, but it also brings in many new investors while running the risk that newly funded investments do not pan out. This shift from the core technology stocks of the Mag 7 to more speculative parts of the market is one potential warning sign of this.

While the 1999 concentrated market resolved itself with a major pullback, such a move is not necessary to resolve the concentrated market. After 2020’s concentrated market, the market broadened in 2021 amidst optimism over the reopening economy. Whether it could be due to economic optimism or, perhaps, sentiment on AI shifting from a narrow group of beneficiaries to a broader set, there is the potential for market returns to be positive and broaden out at the same time.

Heading into 2026, it still makes sense to own Mag 7 stocks, but investors need to be cautious of their large (and correlated) impact on the overall stock market. There is also reason for caution if the Quality profile of the Mag 7 members starts to shift. But diversification is needed beyond just these leaders. Rather than look for stocks that have superficial similarities of exciting stories, we continue to look for business that have actual underlying Quality metrics of durable cash generating businesses with good balance sheets and solid free cash flow. While the stories are not as exciting, these characteristics have historically delivered good shareholder returns and, despite the recent poor performance, remain appealing. Looking forward to 2026, Can Quality Stage a Comeback?