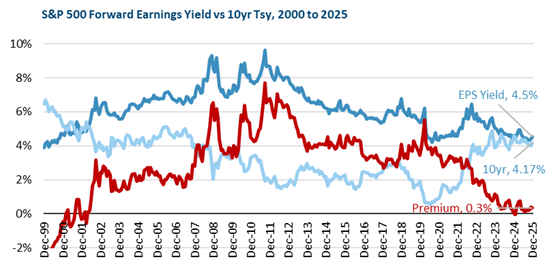

Tying together stocks and bonds, the two important themes of interest rates and equity valuation are reflected in earnings yield premium. Chart 1 below shows the earnings yield on the S&P 500, the yield on the 10yr Treasury, and the difference between the two, known as the Equity Premium.

Chart 1

A higher Equity Premium means stock investors are getting more compensation relative to bonds. From 2002 to 2007, prior to the Fed’s QE interventions, a 1-3% Equity Premium was common. Although the Premium briefly spiked in early April amidst the market decline, it has been close to 0% for most of 2025, and by the end of Q4 it was back down to .3%, as the rising stock market reduced the EPS yield. This relationship can improve by rates falling, stock prices falling, or earnings rising.

Chart 2

The last time the Earnings Yield Premium was negative was in 1999, coinciding with the market peak. The positive is that today’s Equity Premium remains above zero, and therefore is not as extreme as at the peak of the dot com bubble. The negative is that it is close, and this could make the stock market sensitive to interest rate moves. Higher interest rates would threaten to push the Equity Premium into negative territory, and if the 10yr Treasury yield were to rise over 4.5%, that could become a headwind for stocks. On the other hand, if interest rates were to move lower towards 4%, then that could be supportive of stock returns.

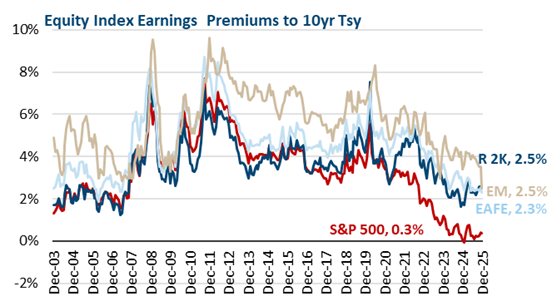

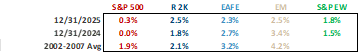

Expanding beyond the S&P 500, Equity Premiums have come down for other major indices. As Chart 3 below shows, Earnings Premiums have come down for all the major indices in 2025. As with the S&P 500, it is best to compare them to the 2002 to 2007 pre-Great Financial Crisis period. On that front, the table shows that after their strong 2025 returns, EAFE and EM are now well below those historic levels.

Chart 3

This compares to their values on 12/31/24 when, collectively, SmallCap, EAFE and EM were all just below their averages. Heading into 2026, the outlier is SmallCaps, represented by the Russell 2000, which, at 2.5%, is above its 2002-2007 average of 2.1%. Additionally, the S&P 500 Equalweight has an Equity Premium of 1.8%, equal to the S&P 500’s 2002-2007 average, and this has improved since a year ago.

Overall, the S&P 500 Equity Premium illustrates why stocks could be sensitive to interest rates in 2026. It also shows that, while there is still a benefit, EAFE and EM Premiums are down notably from the start of 2025 due to good performance and may not offer as much benefit for 2026. Finally, the Russell 2000 and S&P Equalweight Premiums suggest that U.S. stocks beyond megacaps may offer some valuation appeal, thanks to Wider Premiums in the Broader Market.