Municipal bonds can offer investors an enticing advantage: tax-free income. This means the interest earned is often exempt from federal taxes and, in many cases, state taxes as well. This can be an appealing feature for investors in higher income tax brackets who are looking for ways to keep more of what they earn.

What Are Municipal Bonds?

Municipal bonds, often referred to as “munis,” are issued by state and local governments to fund public projects like schools, roads, bridges, and other infrastructure. Think of them as a loan that investors make to local governments to help finance community improvements.

There are two main types of municipal bonds:

- General Obligation Bonds (GO) – These bonds are backed by the full faith and credit of the issuing municipality. They are considered lower-risk because they are secured by the taxing power of the municipality.

- Revenue Bonds – These bonds are backed by the revenue generated from a specific project being funded. They tend to carry a higher risk since repayment depends on that project’s income. However, they usually offer a higher yield to compensate for this additional risk.

In addition to steady, tax-advantaged income, municipal bonds also serve a broader public good by financing projects that benefit local communities.

However, while munis are often viewed as “safe,” investors should also keep in mind:

- Credit risk – Though defaults are rare, municipalities can face financial distress.

- Call risk – Many bonds can be called (paid back early), which may impact long-term income.

Balancing tax benefits with these risks is key to making the right decision.

Federal and State Tax Benefits

Municipal bonds are exempt from federal income taxes to encourage investment in public works. In many cases, they are also exempt from state and local taxes if you live in the state where the bond is issued.

Example: If a Massachusetts resident buys a bond issued by the Commonwealth of Massachusetts, they may avoid both federal and state taxes on the interest earned. However, if that same person buys a bond from Florida, they would still owe Massachusetts state income tax on the interest.

Important Planning Note: Not all bonds issued within your state are automatically exempt from state taxes. Some bonds, even if issued locally, may still be taxable depending on how they are structured. In addition, while municipal bond income is generally excluded from taxable income, it is still included in your Adjusted Gross Income (AGI) for purposes of calculating Medicare’s Income-Related Monthly Adjustment Amount (IRMAA). This means tax-exempt interest could push certain retirees into a higher IRMAA bracket, resulting in higher Medicare premiums. For example, $40,000 of muni bond income could raise a couple’s AGI enough to increase their annual Medicare Part B and D premiums by more than $2,000 (you can refer to the 2025 Important Numbers PDF to view the various tax brackets).

AMT Considerations

Alternative Minimum Tax (AMT) is designed to ensure high-income earners pay at least a minimum amount of tax. While most municipal bonds remain exempt, certain private activity bonds (used for projects like hospitals, sports arenas, or housing developments) may be taxable under AMT rules.

This makes it critical to review the characteristics of each bond carefully before investing. Coordination with your financial and tax professional is highly recommended.

Understanding Tax-Equivalent Yield

Tax-equivalent yield (TEY) is a tool used to compare the value of a tax-free bond to a taxable investment. It shows what a taxable bond would need to yield to match the after-tax return of a municipal bond.

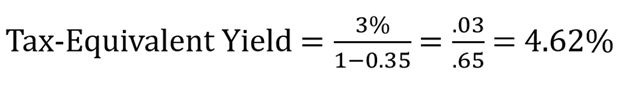

Example: If you are in the 35% tax bracket and a municipal bond offers a yield of 3%, the tax-equivalent yield would be:

This shows us that a taxable bond would need to yield 4.62% to match the after-tax income of the 3% municipal bond. This comparison helps investors evaluate whether a muni bond or a taxable bond provides better net value.

Important Planning Note: It is especially important to review your tax bracket annually to determine if investing in Municipal Bond funds are the right fit for your portfolio. There is a significant Tax-Equivalent Yield difference when someone is in the 35% bracket vs. 12% bracket.

The Grimes Perspective

Municipal bonds can be a valuable addition to a diversified portfolio. With their combination of tax advantages, community impact, and steady income, they can be especially appealing to high-income investors in high-tax states. However, because of nuances like AMT exposure, state-specific rules, credit risk, and call features, municipal bonds aren’t a one-size-fits-all solution. If you’re wondering whether muni bonds fit into your tax strategy, ask your Grimes Advisor to run a personalized tax-equivalent yield analysis and evaluate how they complement your broader financial plan.

Related: What Are Treasuries, Municipals, and Corporates? Bond Types Explained

This article is part of an ongoing series aimed to help build overall financial literacy, and was co-authored by Grimes & Company’s Financial Planning summer intern Gavin Walsh. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./