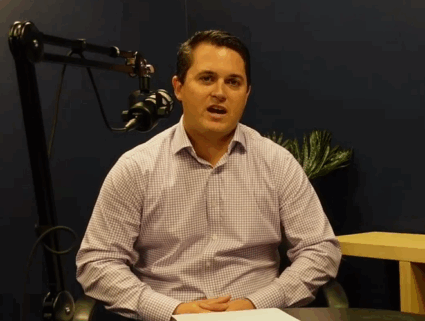

In the first of our new video series, Grimes & Company Advisor Jordan Letendre gives a high-level rundown of the various accounts you may want to consider when optimizing your path to retirement, and how to put them to work together to maximize your plans. Whether you’re just starting your retirement journey or actively refining your plan, this conversation offers thoughtful advice you can put into practice right away.

Watch the video below:

Video Transcription:

Hi everyone, my name is Jordan Letendre. I’m a financial advisor here at Grimes and Company. And today we’re going to be talking about ways to maximize the amount in your retirement plans.

I’m really going to focus on three different types of retirement accounts, which would be your 401k, an IRA or an individual retirement account, and an HSA or a health savings account.

A 401k is an employer sponsored retirement plan. And the wonderful thing about a 401k is they’re typically easy to set up. The money gets deducted directly from your paycheck and goes into the 401k account. The other great thing about the 401k is typically employers will offer a match. So if you contribute, let’s say, 5% of your salary to the 401k, a lot of employers will match that. Now, the match is a critical piece. It is free money, right? So we need to be making sure that you are fully taking advantage of the employer match.

The next type of retirement account that I’ll talk about is the IRA or individual retirement account. Traditional IRAs, it’s pre-tax money, it grows tax-deferred, you’re getting a tax benefit now, but you will pay taxes down the road.

Roth IRAs, you put the money in, no tax benefit upfront, it grows tax free and comes out tax free. So there’s a lot of different variables to this around what are your expected tax rates going to be now and in the future. There are different laws around contribution levels or if you can even contribute to an IRA or a Roth IRA, depending on your income, whether you have a plan at work or not. So these are the complexities again where working with a financial advisor can really help you understand your unique situation and how you can maximize an individual retirement account.

The last type of account we’ll talk about today is the Health Savings Account or HSA. So what a Health Savings Account is, if you have a high deductible health plan at work, what you are able to do is put some money aside into the Health Savings Account every year, and it is the only savings account that is actually triple tax advantaged. What do I mean by that? The money that you put into the health savings account you are getting a tax deduction in the current year on your income. That money can be invested inside of the HSA and can grow tax-free.

And then down the road, you take that money out for qualified medical expenses, it also comes out tax free. So obviously some really great tax advantages to the health savings account.

When you’re thinking about all of these different accounts and where should I contribute and how much, I almost think of it as like an order of operations where the first thing you want to make sure you’re taking advantage of, getting that full employer match in your 401k.

From there, you can then shift additional dollars that you may have to save into an IRA.

The IRA is gonna give you a little bit more flexibility typically in terms of investment options. Then the third step would be that health savings account we talked about, okay? Triple tax advantage, don’t forget that. Try to max out that health savings account if at all possible.

But even starting to save early and often into some of these accounts it will add up over time and really set you up for a great spot down the road. So again thank you for watching my name is Jordan Letendre with Grimes & Company. Feel free to reach out if you’d like any help or guidance with your financial situation.

Important Disclosures:

This presentation is intended for general information purposes only. No portion of the presentation serves as the receipt of, or as a substitute for, personalized investment advice from Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company) (“Grimes”) or any other investment professional of your choosing. Different types of investments involve varying degrees of risk, and it should not be assumed that future performance of any specific investment or investment strategy, or any non-investment related or planning services, discussion or content, will be profitable, be suitable for your portfolio or individual situation, or prove successful. Neither Grimes’ investment adviser registration status, nor any amount of prior experience or success, should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor accounting firm, and no portion of its services should be construed as legal or accounting advice. No portion of the video content should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Copies of Grimes’ current written disclosure Brochure and Form CRS discussing our advisory services and fees are available upon request or at grimesco.com.