I read the following line in the Wall Street Journal this morning (8/20/2021), “US equities on track for one of the biggest weekly pullbacks of 2021, with all of the major indexes off more than 1%. Risk-off this week driven by several different factors, particularly the pickup in growth concerns surrounding the spread of the Delta variant.”

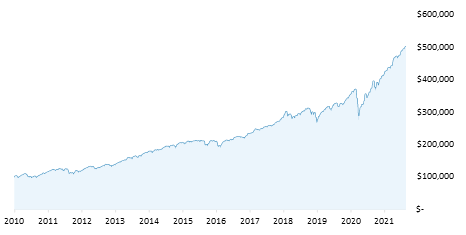

So, a 1% weekly move is now newsworthy? In normal times daily moves of 1% are the norm. We created a chart depicting declines of over 5% and measuring the duration of those moves (see Chart below). Since the Global Financial Crisis, the current streak is second only to 2017.

(Source: Orion)

S&P 500(TR) – Number of consecutive days since 5.00 % Drawdown

(Source: Orion)

It is “normal” to experience three separate declines of 5% or more and one decline of 10% or more per year on average since 1950. We have not had a 5% decline since November 2020! By the way, the S&P 500 has advanced 38% since the last 5% decline and has doubled since March 2020 – the fastest market doubling in the post-WWII era. It sounds like I need to write an addendum to “The year of unrelenting superlatives: 2020 was the most “est” year ever! ”.

Earlier this year I thought that by the third or fourth quarter the markets would be focused on booming economic growth versus inflation with the specter of faster-than-expected Fed tightening leading to higher levels of market volatility. We wrote about this earlier in the year in this blog, “Dry Powder versus Powder Keg”. This is not happening (yet), and one reason could be the Delta variant. The Delta variant is magnifying COVID concerns, especially in less developed countries that are key players to the global supply chains. Supply chain disruptions cast BOTH inflation measures AND growth estimates into doubt thus giving the Fed a relevant excuse to slow play the tightening of monetary policy. Perversely, this added COVID wrinkle could actually be reducing volatility for markets, at least for now. Inflation worries can simply be ignored and labeled “transitory.” Growth is strong but not overwhelming, and we can all just sit back and enjoy the wonderful earnings reports (S&P 500 is on track for the best quarterly earnings report since 2009 with 88% of companies beating estimates according to CNBC). As discussed in “The Big Picture – COVID is here to stay, but will be easier to live with”, we anticipate the supply chains to be mended over the coming months and quarters and the specter of COVID variants to fade over time. Tighter monetary policy will likely be a headwind for markets at some point, and while it is delayed and drawn out, it is coming. Could a decline in variant concerns actually lead to a period of higher volatility? One thing is for sure, volatility cannot go much lower.

Important Disclosure Information:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.