The year of unrelenting superlatives: 2020 was the most “est” year ever!

- Fastest decline ever from an all-time high to bear market levels (down 20%)

- Fastest ever return to record highs from bear market levels

- Biggest fiscal stimulus ever with the $2.2 trillion CARES Act

- Largest monetary stimulus ever with $3 trillion in QE (asset purchases) and moving Fed Funds rate to zero (more to come in 2021)

- Highest ever trailing one-month volatility, which reached 5% at the end of March (meaning the average daily change during the period was 5%, up or down)

- Highest rate of unemployment (14.7%) since the Great Depression and fastest loss of jobs ever

- In April the SmallCap Russell 2000 was up 18%, for its best month since its creation in 1978

- Oil briefly traded at its lowest price ever of NEGATIVE $35 per barrel, on 4/21

- Q2 GDP declined a record 32% (or down about 9% year-over-year)

- Q3 GDP rose by a record 32% (though still down 5% year-over-year)

- US companies issued a record $368b of stock, more than 50% above the prior high

- Largest addition to the S&P 500 ever, Tesla

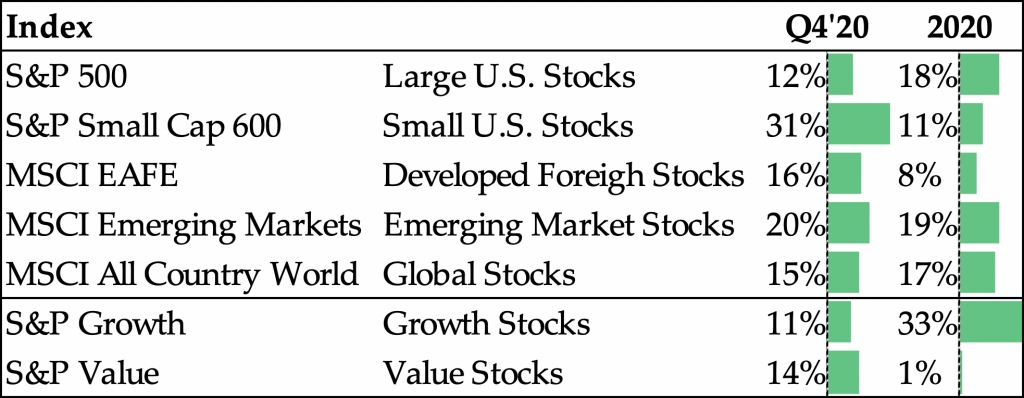

2020 lays claim to the fastest market cycle in history – only 128 days from peak to trough to peak. The fastest and steepest bear market selloff ever was triggered when the Coronavirus pandemic caught the world by surprise and led to the biggest economic contraction in modern times. April’s 21 million payroll decline and 10-point unemployment jump, from 4.4% to 14.7% (the highest level since the Great Depression), were not merely records, but orders of magnitude more than prior records. So too was the 33% GDP decline in the second quarter. This was followed by unprecedented monetary ($3 trillion) and fiscal ($2.2 trillion and counting) stimulus that ignited the quickest bear market recovery of all time. The market did not stop at full recovery and plowed forward to new highs in the fourth quarter. The MSCI All Country World Index (ACWI) advanced 15% for the quarter, bringing it up 17% for the year, a level considered unthinkable during the depths of the selloff in March.

The early recovery from the March lows was led by a very narrow segment of the market, mostly technology and biotech names that rallied aggressively as investors rewarded companies with earnings growth, flexible work forces, and asset-light balance sheets. This is illustrated by the massive gap in 12 month returns between the S&P Growth Index and the S&P Value Index that reached 33% by the end of Q3; this is the biggest such disparity ever, surpassing even the tech bubble in 1999. In the last client newsletter, we wrote that “trees do not grow to the sky” and that for this market to continue higher there needed to be a change in market leadership, with out of favor areas of the market leading technology stocks. That is exactly what happened in the fourth quarter. Value beat Growth by almost 4%, and Foreign (MSCI EAFE Index +16.1% Q4) and Small Cap (S&P SmallCap 600 Index +31.3% Q4) finally beat the S&P 500 (“only” +12.1% Q4). The worst market sectors through the third quarter led markets higher in Q4. This is illustrated by Energy (+27.8% Q4, -33.7% ‘20) and Financials (23.2% Q4, -1.7% ‘20) compared to Technology (+11.8% Q4, +43.9% ‘20). While the reversal was notable, so too was the prior multi-year period of S&P 500 dominance. One key question going forward is whether these relative shifts are here to stay. There could be plenty of flip flopping between high-flyers and everything else as traders try to adjust their compasses.

Bond yields reached their lowest levels ever in 2020 with Ten Year Treasuries hitting 0.49%, as the prospect of slow growth and aggressive QE programs from multiple central banks around the world have rates at the lowest of all time globally. Taking a look at 10 year sovereign bond yields around the globe, investors need to pay to save in Germany where rates are at -0.58%, and even Spain (0.04%) and Italy (0.54%) can borrow money more cheaply than the US (0.92% as of year end). Perhaps the biggest risk to the market would be central banks changing policy and reducing accommodation, which is improbable in the short run, but would likely give the market fits. With this fear, one logically thinks of inflation, but inflation is dead, right? Or is it not?

Looking towards 2021, there is a lot of dry powder that could fuel the economic recovery, as evident in a few more superlatives. Excess Savings (Personal Income – Personal Spending, minus its 5-year average) as a percentage of GDP exploded to 18.7% in Q2 (yes, the most ever), a level compared to 3% at other peaks. For the first time ever Disposable Income (Personal Income minus taxes) was greater than total GDP, at $18.4 versus $17.3 trillion. Both records were achieved due to the unique combination of tremendous stimulus and a restricted economy that prevented much in the way of economic activity, even for those who wanted to spend. There is A LOT of money ready to fuel the economy. The last time I checked, more dollars and the same amount of “stuff” means each dollar is worth less, which is called inflation. Just don’t tell the economists.

What an incredible year. 2020’s unprecedented economic disruption was driven by an almost unimaginable global pandemic, not seen in a century. Fortunately, tremendous efforts from medical professionals and research scientists have us in the early days of the largest global vaccine roll out ever developed in the shortest amount of time, by far. As more people are vaccinated, economies should continue to reopen as 2021 progresses. How much of this is priced into these levels? Will the stimulus lead the Fed to change policy? If so, what does that mean for assets? All these questions will be explored in the coming months.

For now, the consensus is for the stimulus to stay for next year and for asset prices to continue higher. Of course, as the pandemic reminded us, the future is unknowable. One thing is for sure – that the world is in uncharted waters with stimulus driving asset prices. In the meantime, we will continue to measure and react to what the markets are telling us, and for now that is to stay invested, stay diversified, and stay nimble.