Despite a brief burst of historically high levels of volatility in the first week of April, and then a second half spent waiting on the eventual resumption of Federal Reserve rate cuts (not to mention the ongoing Fed chairman selection process), interest rates drifted lower in 2025, supporting a solid bond market return of 7%, as measured by the Bloomberg Barclays Agg. When bonds earn more than their yield, that is called “outearning their coupon.” The key was that 2025 started with interest rates reflecting a reasonable economic and Fed outlook.

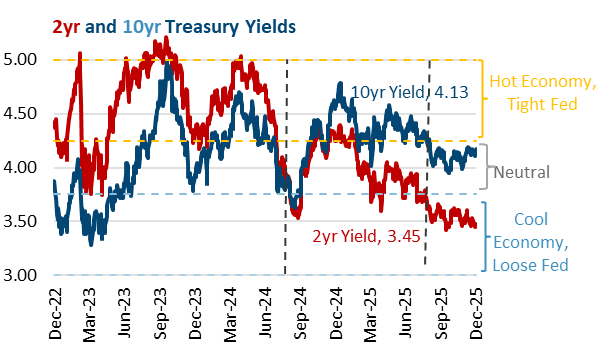

The question for 2026 is if a similar return is possible. To help figure this out, our “market expectations” model remains a helpful tool, where we compare current market interest rates relative to the embedded Fed and economic expectations. Assuming 2% inflation and 2% trend growth, we get a 4% neutral interest rate, bracketed by a 50 bps 3.75% to 4.25% neutral range. Chart 1 below shows the 2yr (Fed policy) and 10yr (economy), as well as orange “Hot Economy, Tight Fed” and a blue “Cool Economy, Loose Fed” ranges. As of 12/31/25, the 10yr (at 4.17%, at the breakpoint between a Neutral and Hot Economy) has held steady while the 2yr (at 3.48%, just pushing into the “Loose Fed” range) reflects the Fed’s cuts.

Chart 1

Many observers may simply assume that if the Fed is planning to cut rates again in 2026, then long-term rates are automatically headed lower. Yet when the Fed commenced rate cuts in September of 2024 and 2025, in both cases, long-term rates rose from the first cut through year end.

The model offers insight into why long-term rates could move up, not down, even as the Fed makes short-term rate cuts. If the market is at first concerned about a weaker economy resulting in lower GDP growth or inflation, that 2% + 2% = 4% sum could become 2% + 1%, and a 3% 10yr can beckon. But once the Fed commences its rate cuts, the market looks ahead to the eventual boost, and the market math shifts to 2% + 3% = 5%. This illustrates how the Fed lowering rates on the short end can push the 10yr higher. Thus, an ongoing decline in long-term interest rates could be a challenge, even as the Fed is expected to make additional rate cuts in 2026.

The Agg started 2025 with a yield of 4.9% at the start of 2025 and, thanks to a duration of 6.5, the 50 bps decline in rates in 2025 allowed the Agg to out return its income with a 7.3% overall return. Now, as of 12/31/25, the yield on the Agg is down to 4.3% and interest rates could be hard pressed to fall significantly below 4%, suggesting there is less room for duration to contribute to total return. With interest rates at levels that are generally in line with the economic backdrop, a reasonable return outlook is the current yield of 4% plus or minus 3%, or 1 to 7%. But it is notable that 2025’s 7% is at the top of this 1% to 7% range, which would suggest that 2026 matching 2025’s bond return could be a challenge. And while markets are reflecting a decent base case, the 4% income return could be periodically overwhelmed by price changes from duration, as a 50 bps move in rates can create a price change of 3%. If interest rate volatility picks up, can Fixed Income Earn Its Coupon in 2026?