During a period with several market extremes, one of the most notable developments in the first half of 2025 was the dollar’s decline: The dollar index’s 11% first half decline was its largest since 1973. Part of the large move thus far in 2025 was due to the dollar rising to close out 2024, on the expectation that pending policy moves would be beneficial to the U.S. economy on a relative basis. Instead, the uncertainty of multiple proposed and then suspended tariff regimes, paired with general concern that the relative strength of the U.S. economy relative to other countries could be pressured this year, helped drive this decline.

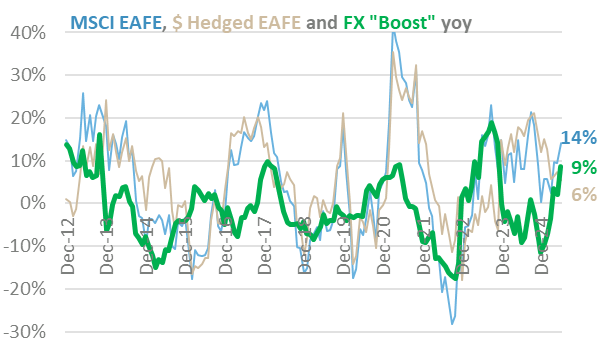

One of the most notable ways foreign exchange (FX) shows up in investment portfolios is via international stock returns, since stocks denominated in a rising foreign currency will get a value boost as their share prices translate back into dollars. Year to date, this has accounted for 14% of the MSCI EAFE’s 20% return, and, as Chart 1 (below) shows, has boosted returns on a rolling 12-month basis by 9%. This rolling boost is near the top of its +/- 10% range of the past 10 years, which was only significantly exceeded in 2023, a move exacerbated by the prior year’s record dollar drag. As of the end of Q2, the move is getting into extreme territory, though could persist for months, or even quarters.

Chart 1

The chart also shows how just six months ago, at the end of 2024, the FX impact was -12%, similarly extreme, but in the opposite direction. Additionally, the impact of currency moves on foreign stocks is not one-sided. While there is an immediate boost to international stock returns from a weaker dollar, it will be counteracted over time by the lower dollar reducing foreign stock profits and U.S.-based companies getting a competitive boost from lower prices. This does not mean international stocks are doomed, but when the dollar eventually stabilizes, the price tailwind will fade quickly while the profit headwind will slowly rise.

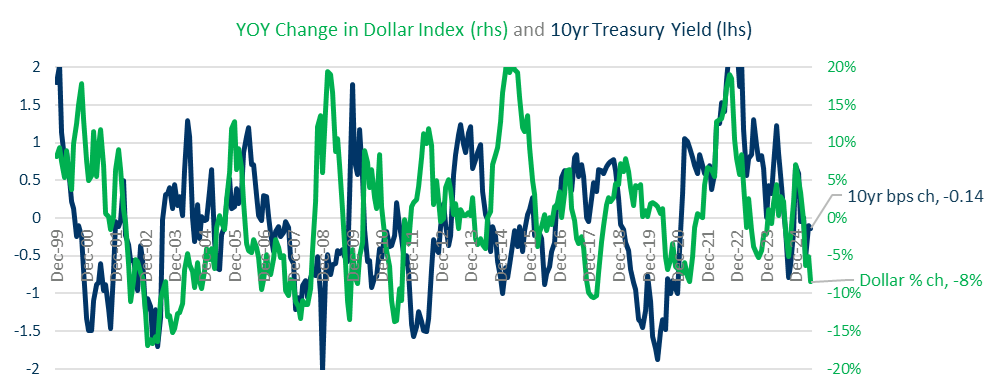

While it is moving towards extreme levels, the FX stock boost could continue as long as the dollar is under pressure. While the path for trade policy is hard to gauge, we can look at other drivers of foreign exchange moves. The yield on the 10yr Treasury and the dollar are linked. When yields on U.S. assets, such as the 10yr, rise, that increases demand for U.S. assets. Although the relationship is not perfect, higher yields should coincide with a stronger dollar. But the recent dollar drop has come with steady (not falling) rates. The relationship is most evident when looking at the change in the dollar index and the change in the 10-year Treasury yield.

Chart 2

Chart 2 (above) shows that the recent dollar weakness, with an 8% decline, has deviated from the relatively unchanged yield of just 14 basis points on the 10yr Treasury.

The key is to understand how the direction of interest rates and the dollar could factor back into international stock returns. Assuming the markets behave normally, the recent dollar weakness should result in either interest rates falling to catch up, or the dollar recovering to match the still steady U.S. rates. If the first scenario unfolded and rates fell to 4% or below, that could keep the dollar weak and support international stock prices. Conversely, if U.S. rates start to rise towards 5% and the dollar reversed course higher, that could unwind the support for international stocks by removing the foreign exchange tailwind at the same time as those stocks are starting to experience the profit headwind.

The one outlier scenario to keep an eye on is if the dollar continues to fall and interest rates were to rise. This would suggest widespread sales of dollar-based assets. While this is not the most likely outcome, it is one more reason to watch how the current relationship between interest rates and the dollar plays out. This relationship between the dollar, interest rates, and international stock returns is why Making Sense of Dollar Changes and International Stock Returns is important.