Unpredictability and uncertainty have been the theme of 2020, far more than when we observed on 12/31/19:

Market forecasting is always difficult and uncertain. The combination of recency bias (what just happened gets extrapolated), return focus (observers focus on returns, which are volatile, as opposed to valuation or other more stable metrics), group think (analysts don’t want to stray too far from the pack), and discerning priced info from what will be the marginal new info (new news will move markets, but forecasts tend to center on narratives already in place) creates many opportunities for error. On top of that, financial markets are massively complicated and interlinked systems and future events are unpredictable.

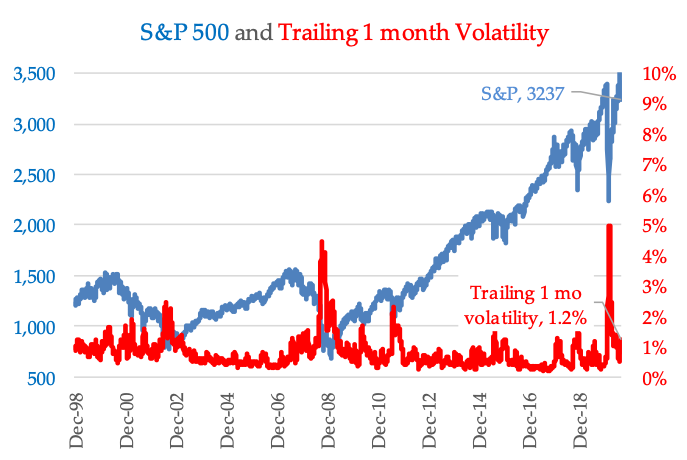

Volatility is the financial market’s manifestation of uncertainty, as investors with a wide range of possible outcomes will have a wider disparity in the price of assets. Q1’20 experienced record levels of market volatility, as the Covid-19 pandemic and, more importantly for the markets, the economic impact of the healthcare policy response of lockdowns and social distancing, drove the markets. As the chart shows, trailing one month volatility hit a record high of 5% at the end of March, then dropped as the market recovered, reaching a low of 0.5% on 8/28/20, coinciding with the market’s high. From that point, volatility has risen as the market pulled back in September, and reached 1.2% on 9/30/20. The drop from record volatility shows uncertainty has been reduced. But the still elevated level shows it has not been eliminated.

One of the main drivers for the market’s elevated volatility is the speed of the slowdown. On 3/31/20, we noted: The 2020 economic impact will be unusual for several reasons. The first is the speed of the stock market decline, the speed of the pending recession, and the speed of the policy response. Events that usually take place over months are happening in weeks, and those that usually take weeks, are happening in days. The market crash, recession and policy response seem to be running in fast forward.