In this two-part series, we’ll provide a comprehensive overview of Required Minimum Distributions (RMDs, covered in this article) that will set the table for suggested strategies for withdrawing RMDs (part two, found here).

If you’ve spent your career diligently contributing to tax-advantaged retirement accounts, such as IRAs and 401(k)s, you’ve probably enjoyed years of tax-deferred growth. Eventually, however, Uncle Sam will want his share, and that’s where Required Minimum Distributions (RMDs) come into the picture. An RMD is the minimum amount you must withdrawal annually from some retirement accounts after you reach a certain age.

The RMD requirement is more than just a tax rule – it’s a major component of your retirement income planning strategy. Understanding how RMDs work, and how to incorporate them into your cash flow plan, can help you avoid costly penalties, reduce unnecessary taxes, and protect your hard-earned savings.

Why Do RMDs Exist?

RMDs exist because tax-deferred accounts were never meant to be permanent tax shelters. Minimum annual distributions prevent retirement accounts from becoming legacy planning tools. Without RMDs, an investor could let their tax-deferred savings remain untouched, passing them along to heirs without ever using them for their intended purpose – retirement Income.

RMD Timing and Taxation

RMDs aren’t new. The Tax Reform Act of 1986 introduced them to make sure retirement savings could not avoid taxes in perpetuity. However, there have been changes to the rules in recent years, most recently via the SECURE Act and SECURE 2.0, which: a) raised the starting age for RMDs, b) eliminated them for Roth 401(k)s (starting in 2024), and c) reduced the penalty for failing to make the minimum distribution.

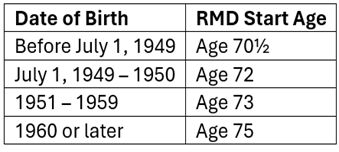

As of now, an investor is required to take their first RMD by April 1 of the year after they reach their official RMD age (as seen in Chart 1). But here’s the catch: If you wait until April 1, you’ll have to take two RMDs in that same year – the first by April, and the second by Dec 31, which is the annual deadline for RMDs thereafter.

Chart 1

In most cases, the full RMD amount is taxed as ordinary income. There is no early withdrawal penalty – even if under the age 59½, in the case of an inherited IRA. When processing distributions, investors can choose to have federal and state (where applicable) income tax withheld. There is one opportunity to avoid tax, and we’ll cover that later.

What Accounts Are Subject to RMDs?

RMDs apply to most tax-deferred retirement accounts. If an investor received a tax break when making the contribution, they are likely accountable for taxes when the RMDs are distributed. This includes Traditional IRAs, SEP IRAs, SIMPLE IRAs, 401(k)s, 403(b)s, and Inherited IRAs (read our article on Inherited RMDs here).

A popular retirement account that is not subject to RMDs is the Roth IRA. Contributing to a Roth IRA does not trigger a tax deduction, and so these investment vehicles are not subject to RMDs during the original account owner’s lifetime. Similarly, while Roth 401(k)s were previously subject to RMDs, they are exempt as of 2024 (via SECURE 2.0).

The RMD Calculation

The IRS has created three different life expectancy tables, the relevancy of each to a specific life stage we’ll outline here:

- Uniform Lifetime Table: An investor uses the Uniform Lifetime Table if they are single, married with a spouse less than 10 years younger, or if the spouse is not the sole beneficiary.

- Example: Elise will turn 75 years old in 2025, and her IRA was valued at $500,000 on 12/31/2024. The IRS factor for age 75 on the Uniform Lifetime Table is 24.6, so Elise’s 2025 RMD would be: $500,000 ÷ 24.6 = $20,325.

- Joint Life and Last Survivor Expectancy Table: An investor uses the Joint Life and Last Survivor Expectancy Table if their spouse is more than 10 years younger and is the only beneficiary. The longer life expectancy factor means lower withdrawal amounts. However, the divisor gets increasingly smaller over time, causing the RMD to be a larger portion of the retirement account each year.

- Example: Nolan will turn 75 in 2025, his spouse is 60, and his account value was $500,000 on 12/31/2024. Nolan’s IRS factor on the Joint Life and Last Survivor Expectancy Table is 28.3, so Nolan’s 2025 RMD would be: $500,000 ÷ 28.5 = $17,544.

- Single Life Expectancy Table: The Single Life Expectancy Table is used for beneficiaries of inherited retirement accounts and calculates RMDs based solely on the inheritor’s age in the year after the original account owner’s death. Recent regulation muddied the waters a bit for these accounts with the introduction of the 10-year rule (read our article on inherited RMDs here). When using the Single Life Expectancy Table, the account owner would subtract 1 from the previous year’s life expectancy factor (i.e., 24.6 → 23.6 → 22.6, etc.) and recalculate the new RMD based on the prior year-end account value. Again, with an increasingly smaller divisor over time, the RMD becomes a larger portion of the retirement account each year.

RMD Account Aggregation

The total amount of an investor’s annual RMD can be aggregated across all IRAs (including Traditional, SEP, and SIMPLE IRAs), meaning the total distribution could come from just one, or any mix of accounts. However, it’s important to note that each 401(k), 403(b), and similar workplace plan must have its respective RMD calculated and withdrawn separately.

What’s the right RMD withdrawal strategy for you? Read the second part of our RMD guide to learn more.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./