It has been reported that over half of all Americans do not fully understand how their income tax is calculated. Here’s a quick primer on how it works.

The single biggest error people make is thinking that you apply the taxpayer’s top tax bracket percentage to the total income.

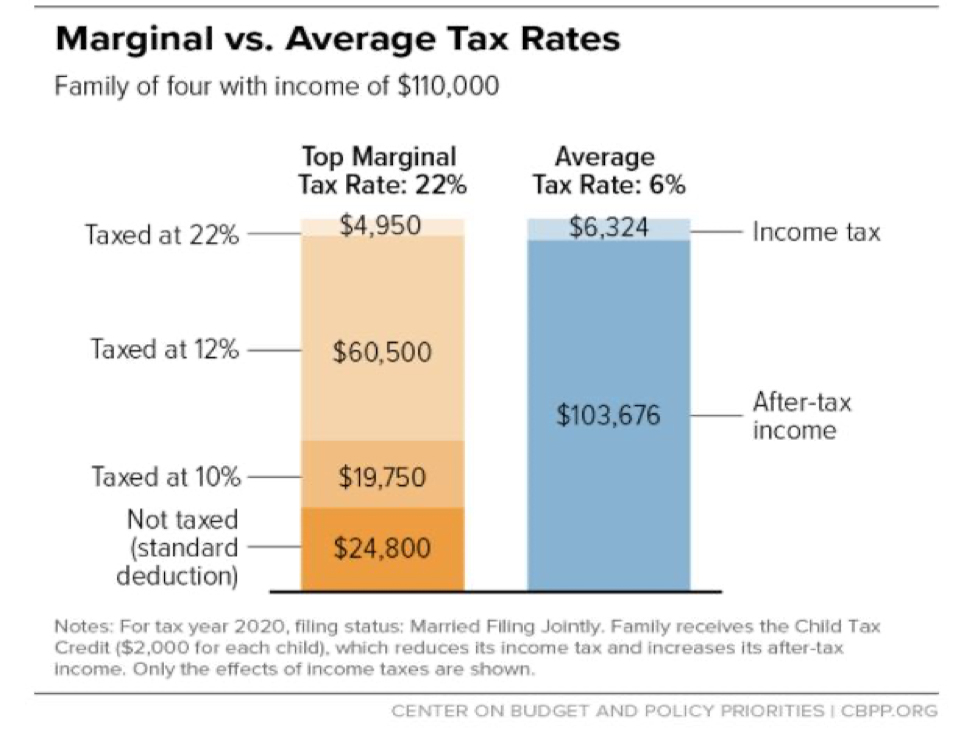

Instead, think of tax rates as brackets that “fill up” with income before moving on to the next bracket. In other words, income is taxed at the rate of the first bracket up to a certain threshold. Income over that threshold is taxed in the second bracket up to another threshold, and so on. In addition, most Americans use the standard deduction, which automatically excludes some of your income from taxation.

In the example below, we look at a married couple with two children with income of $110,000. As you can see, the first $19,750 of income (after the standard deduction) is taxed at 10%, which equals $1,975 in tax owed by this family. The next $60,500 of income is taxed at 12%, which equals $7,260 in tax owed.

Finally, this family’s income spills over to the 22% tax bracket, with $4,950 of income taxed at 22%, which equals $1,089 in tax owed. If we add the tax due for all three brackets together, it totals $10,324. Then, child tax credits of $4,000 ($2,000 per child) are deducted and the income tax owed is $6,324. Thus, this family is effectively paying 6% ($6,324 / $110,000) in income tax.

There are currently seven different tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Each rate applies only to a specific bracket of income, rather than to total income. Also, there are different brackets depending on how you file which is referred to as your ‘filing status’. Filing status could be married filing jointly, single, or head of household, to name a few.

What’s My Marginal Rate?

When someone says they are in the 24% bracket they are referring to their ‘marginal’ rate, or the highest bracket of taxable income. The easiest way to figure out your marginal tax rate is to look at the federal tax brackets and see in which bracket your taxable income ends. In the example above, the family is in the 22% marginal bracket.

What’s my Average Rate?

Everyone has an ‘average’ or ‘effective’ rate. The average rate is simply the actual percentage of your total taxable income that goes to the IRS. To calculate this rate, you divide your tax liability (what you owe) by your total taxable income.

Generally, marginal rates are used for making decisions about what will happen if your income or deductions increase or decrease. For instance, if you are trying to determine the impact of a specific change in income, such as processing a Roth conversion or charitable gift, your marginal tax rate will typically tell you the answer. If you are trying to determine how much of your income to withhold for taxes, then your effective tax rate may give you a better answer.

Understanding the difference between your marginal tax rate and your average (or effective) tax rate can be an important tax planning tool. Please reach out to your Advisor if you would like to discuss any of the tax planning ideas mentioned in this blog and always remember to consult with your Accountant for tax advice prior to making any changes.

Important Disclosure Information:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.