The mandates for the Federal Reserve are to fight inflation, maintain full employment, and provide market stability. For the last thirty years the Fed has been focused on the latter two, keeping the economy chugging forward with a steady dose of stimulus, supporting spending and asset price appreciation. Now the focus is on fighting inflation, which means slowing the economy and pressuring asset prices and speculation – a far more unpleasant backdrop.

The Federal Reserve has a powerful set of tools for managing monetary policy. They set the short-term borrowing costs, including what banks pay to borrow directly from the Fed and what interest rates banks must pay for keeping excess reserves on their balance sheet. They can perform open market operations, buying and selling securities in the secondary markets, to provide price stability. Since the Global Financial Crisis (2008-2009), the Fed began performing large scale asset purchases, known as Quantitative Easing, to influence long-term borrowing costs and act as a buyer of last resort to stabilize financial markets. However, what often goes unsung is the simple tool of transparently communicating to the markets what policies will be implemented and when, known as Forward Guidance.

In the early days of the Federal Open Market Committee (FOMC), policy action was performed under a shroud of secrecy and only disclosed in hindsight. Traders had to speculate as to what the actual Fed Funds Rate was at any given time. From the FOMC’s first meeting in 1936 until 1967, each year’s policy actions were announced a year later. It was not until 1994 that policy decisions were disclosed at the end of each Fed meeting.

Fast forward to today, the FOMC is completely transparent with their policy and direction. The Fed meets eight times per year, holds press conferences after each meeting, and releases minutes of each meeting to the public two weeks later. The Chairman performs a televised report to Congress twice a year, during which direct questions are fielded from (often unfortunately misinformed) politicians. They even distribute easy to follow tools such as the dot-plot, which graphically illustrates what each Fed governor (not labeled by name on the report) expects interest rates to be in the future. Fed governors regularly have speaking engagements to communicate, directly to the public, their personal views within the context of the Federal Reserve Board’s broader opinion. Forward Guidance allows the markets to accurately price future Fed policy into markets very quickly.

Credibility of Central Banks is the most important determinant of successful monetary policy, and if the markets believe the Central Bank, then forward guidance becomes the most powerful and fastest-acting tool in the arsenal. An early example of this was when, in 2012, ECB President Mario Draghi stemmed the crisis in the euro by famously saying that the European Central Bank would do “whatever it takes” to support markets. Eurozone stock indices bottomed that very day, many rallying over 70% in the coming 12 months. In the depths of the Covid economic meltdown, the Fed stated on March 23, 2020, that QE would be expanded indefinitely, including the purchase of mortgage backed and corporate debt (including non-investment grade bonds), to directly support the economy. The S&P 500 bottomed that very day and proceeded to rally over 100% in the next year and a half.

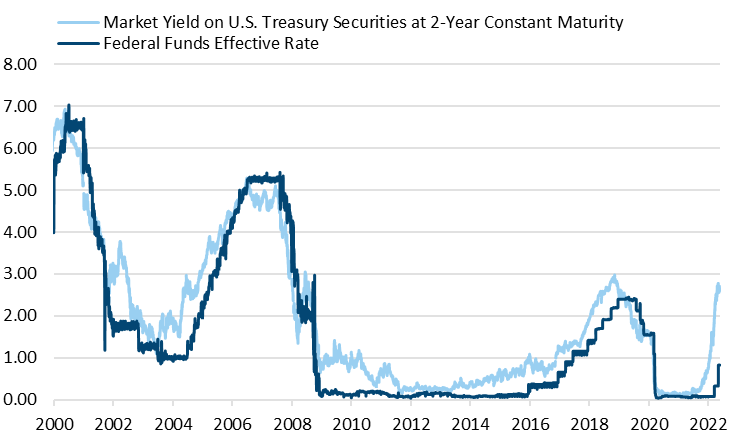

Last year, despite early signs of inflation, the communications from the Fed indicated that they would not move to tighten policy too quickly over fears of additional waves of Covid on a fragile economy. Many Fed Governors said they could wait and then move more swiftly in 2022 if needed to address an inflation problem. That is exactly what they did by changing their communications and projections in the January meeting, and then guiding the markets to the possibility of larger and more frequent rate hikes. The market proceeded to price in an entire year’s worth of aggressive rate hikes by the end of the first quarter, as illustrated by the jump in the 2-year Treasury yield this year (see Chart). Anybody who says the Fed is behind the curve is simply looking at their actions and ignoring the concept of their most powerful tool – guidance.

The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity.

(Source: FRED, Federal Reserve Board of Governors, US)

https://fred.stlouisfed.org/

So, for those that are worried about severe or prolonged recession, remember that Fed policy can change quickly and very effectively influence market price levels. The process of taming inflation is not pleasant, but the faster price pressure is controlled, the sooner central banks can return to easier monetary policy. While a prolonged period of difficulty is certainly possible, the Fed’s tools are faster and more effective than ever, which should mean a smoother economic cycle and easier investment environments over the long run.

Important Disclosure Information:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.