The most powerful force in financial markets are the central banks, which set policy directly influencing economies. The Fed has two main mandates: 1) maintain price control (control inflation) and 2) maintain maximum employment (prevent severe recessions). During a normal market cycle, the Fed will raise interest rates when the economy is running hot with inflation too high, and they will cut rates to stimulate a slowing economy if inflation is in check. However, are there long-run cycles of biases in Fed policy? While both mandates are supposedly of equal importance, are there long periods where one mandate will be more important to the Fed with notable implications for the market?

What the market expects the Fed will do in the future is manifested in bond yields. Yields rise (bond prices fall) when future expectations are for rate hikes (restrictive Fed policy), and yields fall (bond prices rise) when future expectations are for rate cuts (stimulative Fed policy).

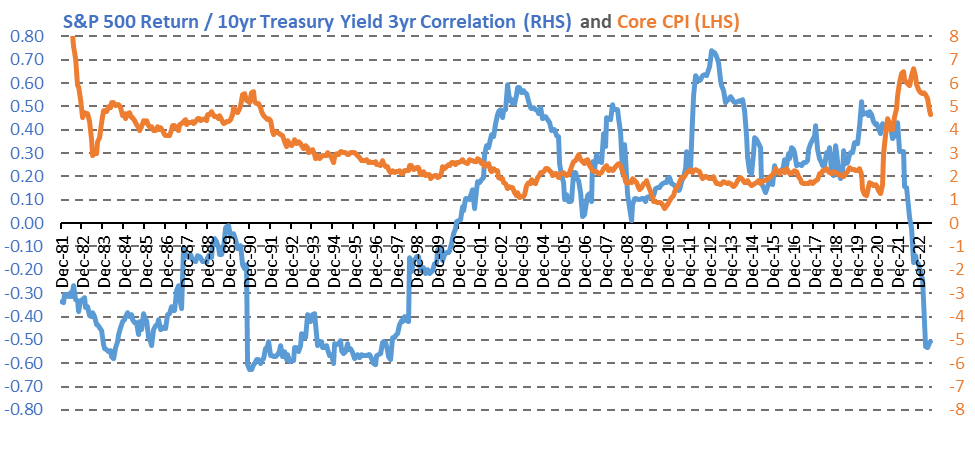

Historically, bond yields and stock prices exhibit a somewhat negative correlation, which can be seen as the blue line on the chart from the beginning of the data series in 1980 to about 2000. All things equal, higher yields mean lower valuations for stocks (described in this previous blog entry) due to opportunity cost, risk premium, and higher discount rates. Bond yields moving higher imply the market pricing expectations for rate hikes in the future, most likely because of higher inflation, which is bad news for both stocks and bonds. However, as you can see from the Chart, from about 2000 until 2022, stock prices and bond yields were generally positively correlated. Why did this happen and why has it reversed in 2022?

Chart 1: S&P 500 Return/ 10yr Treasure Yield 3yr Correlation (RHS) and Core CPI (LHS)

(Source: FactSet)

Prior to 2000, inflation (as measured by Core CPI, orange line on the chart) was generally 3% or higher, and during that period, changes in interest rates were negatively correlated with stocks. But after 2000, inflation fluctuated around 2%, and the correlations flipped. Inflation became of little immediate concern for the Fed or the markets, freeing the Fed to focus squarely on supporting the economy and preventing deflation. What ensued was a confounding period of hyper monetary stimulus, yet low growth. This stretch of time will be remembered for declining and very low borrowing costs as rates approached zero (negative in Europe and Japan) and the lowest bond yields in history, thanks to Quantitative Easing. Towards the end of this period, from the Global Financial Crisis to Covid, there were no recessions.

During this period, where deflation (recession) was the sole focus of the Fed and market, bond yields and stocks exhibited a somewhat positive correlation. In a low inflation environment, higher Treasury yields implied confidence in the economy, which was good for stocks. Vice versa, lower Treasury yields implied expectations of rate cuts in the future, which signaled concern about the economy and therefore bad news for stocks. All things equal, when the primary concern is recession, not inflation, then bond yields and stocks have a positive correlation: bond yields up = stock prices up, and vice versa.

As you can see on the chart, this all changed again in 2022. Covid, and the mind-boggling amount of stimulus that followed, catalyzed this paradigm shift by ushering in a new environment where inflation became part of the equation again. The massive $6 trillion monetary and fiscal money printing here in the US in response to the Covid threat, coupled with damaged supply chains and compounded by Russia invading Ukraine, rewrote the supply/demand equation in a very short time and caught the world flat-footed, resulting in a wave of global inflation. As inflation surged back over 3%, the negative correlation between yield changes and stock prices returned.

So where do we go from here? If history is any guide, then we can expect the next cycle to be different than the past twenty years. One main difference is that Fed policy may have to focus on both mandates, price stability (inflation) in addition to employment and orderly markets (deflation). Inflation has come down nicely, and many expect it to settle in the realm of the Fed’s 2% target sometime soon. That said, the specter of a resurgence could exist for some time because of a very tight labor market and deglobalization, and that is likely to prevent a return to the policies of the first twenty years of this decade. Consumers and the populace do not like recessions, but they are intolerable of inflation. Those expecting to see massive stimulus, rate cuts, and policy accommodation may be sorely disappointed. Instead, expecting higher average borrowing costs, higher bond yields, and a return to a more normal business cycle is more likely, since it is reasonable to think that there are limits to the amount of stimulative policy that can be injected in response to tomorrow’s recessions.

Important Disclosure Information:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.