After an incredible recovery on the heels of COVID stimulus, equities continue to levitate in the early part of 2021.

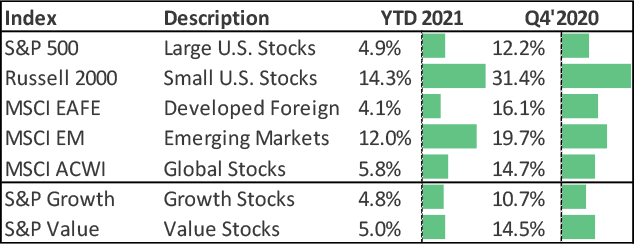

In the last several newsletters we forecast that the long reign of the S&P 500 as the perennial top index, thanks to big positions in Large Cap growth, could finally be coming to an end, or at least a pause. The disparity between the trailing 12-month returns of the S&P Growth and the S&P Value hit 33% last year, by far the largest in history, and as the old adage goes: “Trees do not grow to the sky”. As we wondered if it was finally time for other sectors to lead the market higher, that is exactly what happened. As you can see in the table, Small Cap, Emerging Markets and Developed Foreign all beat the S&P 500 index in the fourth quarter, and that trend has continued thus far in 2021. Over the past six months, Value stocks have managed to outpace Growth, as well. As the economy starts to accelerate later in the year, this could continue as economically sensitive segments of markets may still have room to run with the recovery, as investors search for better valuations.

Is the S&P 500 finally passing the baton to other areas of the markets? Value finally outpaces Growth after record disparity of returns

Markets have been responding to the prospect of continued improvement as 2021 progresses. GDP growth expectations continue to be revised higher, now expected to exceed 4% for 2021 over a higher base for 2020 than was anticipated last year, and we expect further upward revisions as the year progresses. As of last June, the December 2021 unemployment forecast was 7.5%, but has since dropped to 5.8% today on rising optimism for the rebound. Another round of fiscal stimulus is working its way through Congress and could be as much as $1.9 trillion. Is this too much of a good thing in the long run?

Last year the fiscal response to COVID was $3.1 trillion, or 15% of the size of the entire US economy ($20.9 trillion), in response to a GDP decline of 2.3% in 2020. Let’s make this crystal clear: The fiscal stimulus was over SIX TIMES the size of the economic contraction it was designed to offset! To be fair, the economic decline certainly would have been much worse without the much needed stimulus at the time, in particular the $1.1 trillion in direct payments and increased unemployment benefits. Nonetheless, does it really need to be doubled now when we are expecting 4.1% growth and 5.8% unemployment this year? Are we still going to do a massive infrastructure bill in addition to all of this? It is no wonder why inflation expectations have jumped, with 10-year implied inflation (10-year Treasury minus 10-year TIPS) surging from 1.1% last May to 2.3% today – a level above the Fed’s stated target of 2%.

Benchmark Treasury Yield has tripled since last summer with implications on asset prices and inflation outlook

The bond market has certainly taken notice as the 10-Year Treasury yield (see Chart) has recently cracked the 1.5% barrier for the first time since before the COVID shutdowns (February 2020), continuing a steady ascent from a low of 0.52% on August 4, 2020. The move higher accelerated on the successful vaccine news in late 2020, and is moving even faster now as expectations remain for a very robust second half to this year, another huge fiscal stimulus package, and the Fed not to tighten in the foreseeable future. Higher inflation expectations equal higher interest rates. If this continues, it could become a stiff headwind for the markets, since as risk-free rates move higher, other investment options become incrementally less attractive and borrowing costs more expensive. Inflation could top the list of market headlines later in the year, especially if we enter an environment where stocks could actually decline on good economic news because of inflation concerns and fear of the Fed raising rates in response. As of yet, stocks have shrugged off the move in bonds, but for how long?

Important Disclosures: Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet. Not a substitute for tax or legal advice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. “Grimes”), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. Please remember that if you are a Grimes client, it remains your responsibility to advise Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.