For years, people have asked the same question: How much money do I really need to retire? It has proven to be a question without a simple answer. Some say the answer is $1 million. It makes for a great headline, but can be misleading. That’s because retirement isn’t a one-size-fits-all calculation; it’s a personal equation.

Contrary to the FIRE (Financial Independence, Retire Early) movement’s focus on hitting a specific “freedom number,” true retirement planning isn’t about crossing a finish line. It’s about aligning your savings with your lifestyle, location, health needs, and how long you expect retirement to last.

For example, a couple retiring in a major city might need $2 million, while the same couple in a rural area could live comfortably with half that amount.

Instead of chasing a single figure, it’s better to use proven guidelines and tailor them to your own situation.

Benchmarks to Stay on Track

If you’re wondering how to measure progress, age-based savings targets can be helpful. One widely used framework suggests:

- 1x your salary by age 30

- 3x your salary by 40

- 6x your salary by 50

- 8x your salary by 60

- 10x your salary by retirement (around age 67)

Another common rule of thumb is to aim for replacing 70–80% of your pre-retirement income once you stop working. For example, if your pre-retirement income is $120,000, planning to replace 75% means targeting about $90,000 per year from a combination of all income sources – Social Security, pensions, portfolio withdrawals, etc.

Example:

Jim and Laura, both aged 60, want to retire at 67. Their combined income is $180,000, and they’ve saved about $1.1 million. Using a 75% replacement ratio, they’ll need roughly $135,000 annually in retirement. After Social Security and a small pension, they’ll need to withdraw about $70,000 per year from savings — around 4.5% of their portfolio. With moderate market returns and some flexibility, their plan looks on track.

The 4% Rule: Helpful, But Not the Whole Story

The 4% rule has been around for decades. It suggests withdrawing 4% of your savings in your first year of retirement and increasing that dollar amount annually with inflation. In doing so, the money could last about 35 years.

In simple terms, for every $1 million saved, you could start by withdrawing about $40,000 per year, then adjust based on inflation, markets, comfort level, and your cash flow needs.

Treat 4% as a guidepost, not a rule carved in stone. Aim to take the minimum amount you need from your portfolio, and plan to adjust for your timeline, risk comfort, and willingness to reduce spending as conditions change. The lower the distributions, the greater the retained growth, and the more money available for you later in retirement. Keeping the monthly distribution rate low also leaves room for lump-sum distributions during the year without causing you to creep into the higher mid single-digit distribution range.

Why Lifestyle and Longevity Matter

Spending patterns matter more than any formula. Retirement typically unfolds in three stages:

Go-Go Years: Early retirement when travel and hobbies push spending higher, often 20–30% more than later years

Slow-Go Years: Spending stabilizes as activity slows

No-Go Years: Health and long-term care often become the largest expenses

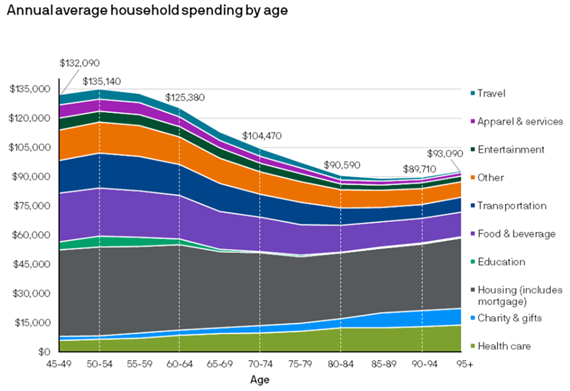

See Chart 1 below for an average breakdown of household spending by age to see how this pattern progresses.

Chart 1, Source: J.P. Morgan Guide to Retirement

Longevity risk, or the chance of living longer than your assets last, is one of the biggest challenges in retirement planning.With people living longer, even small differences in spending or returns can compound over 30+ years. Inflation adds to this challenge, which is why maintaining a mix of diversified investments and guaranteed income sources can help preserve purchasing power.

Beyond the Numbers: What Does Retirement Look Like for You?

The financial side is only one part of the story. The emotional and lifestyle transition – how you’ll spend your time, maintain purpose, and balance flexibility with structure – plays a huge role in whether retirement feels fulfilling.

Financial planning works best when it supports a clear vision for how you want to live each day.

Don’t Forget Health Care and Social Security

Health care is one of the more unpredictable expenses in retirement. Recent estimates show the average 65-year-old couple needs $315,000 to cover health care and medical costs throughout retirement. Planning for these costs ensures they don’t catch you by surprise.

Social Security provides an important income base, but it typically replaces only 30–40% of pre-retirement income. Your savings and investments fill the gap.

Pulling It All Together

So, how much do you really need to retire? There isn’t one single figure that works for everyone, but instead:

- Estimate your income needs using a 70%–80% replacement range of pre-retirement income.

- Subtract guaranteed sources such as Social Security and pensions.

- Determine the gap that your savings and investments need to cover.

- Check your savings progress against age-based benchmarks and adjust your contributions as needed.

- Stress-test your plan and maintain flexibility so you can adapt to markets, lifestyle changes, or unexpected expenses.

A Quick Gut Check

Many couples find that one partner handles most of the finances. Before retirement, have an open conversation about how comfortable each of you feels managing income, investments, and spending. It’s not just about what you’ve saved; it’s about making sure both of you feel confident using it.

The Grimes Perspective

The real secret to retirement planning isn’t chasing someone else’s “magic number.” It’s defining what financial freedom means for you and building a plan to match.

Benchmarks and rules of thumb are useful guides, but your plan should be personal. By reviewing your progress regularly, and preparing for big-ticket items like health care, you can feel confident enjoying retirement on your terms.

At Grimes & Company, our CERTIFIED FINANCIAL PLANNER™ professionals can help you model your personal retirement number — integrating savings, spending, Social Security timing, and health care projections — to ensure your plan reflects both your lifestyle and long-term security.

This article is part of an ongoing series aimed to help build overall financial literacy, and was co-authored by Grimes & Company’s Financial Planning Associate Cameron Eddy. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./