Bond credit ratings are a powerful tool that help investors assess how safe, or risky, a bond investment might be. Whether you’re considering U.S. Treasuries, municipal debt, or corporate bonds, these ratings offer a window into an issuer’s financial strength and the likelihood they’ll repay what they owe.

(New to bonds? Start with our introductory article here or explore our breakdown of bond types.)

Understanding Credit Ratings

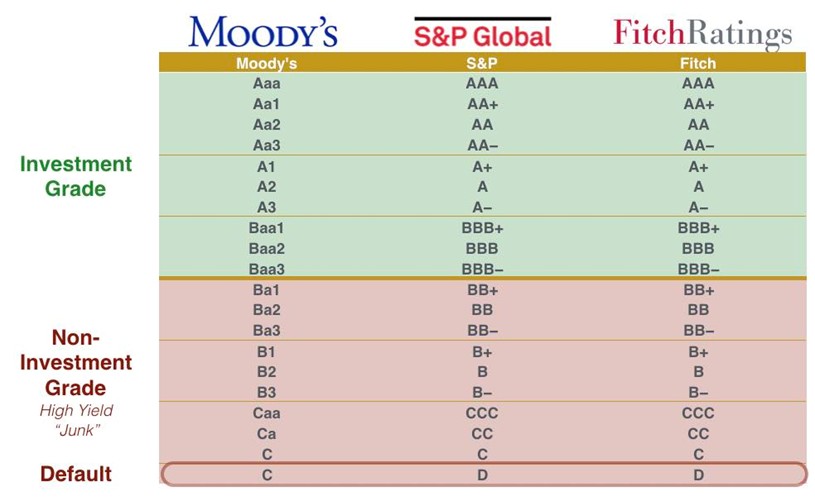

Credit ratings are issued by three independent agencies – S&P Global, Moody’s, and Fitch – which analyze a bond issuer’s ability to repay its debts. While each agency uses a slightly different scale, their goal is the same: to estimate how likely it is that a bond issuer will make timely payments of interest and principal. Bonds are broadly categorized as:

High Yield (Junk) – Higher risk of default, but typically offer higher yields; rated BB+ and below.

Investment Grade – Considered safer and more stable; rated AAA to BBB- (S&P/Fitch) or Aaa to Baa3 (Moody’s).

Chart 1 (Source: https://www.etftrends.com/financial-literacy-channel/understanding-high-yield-bonds/)

Chart 1 captures a comparison of credit rating scales from S&P, Moody’s, and Fitch, showing how each agency classifies investment-grade and junk bonds. These ratings apply across all types of bonds, from Treasuries to municipals to corporate debt, and allow investors to compare credit risk consistently.

What Is Default Risk?

Default risk is the possibility that a bond issuer will fail to make timely interest or principal payments. Bonds with the highest credit ratings, like U.S. Treasuries (AAA), are considered extremely unlikely to default. On the other hand, bonds rated in the “junk” category may offer much higher yields but also carry real repayment risk.

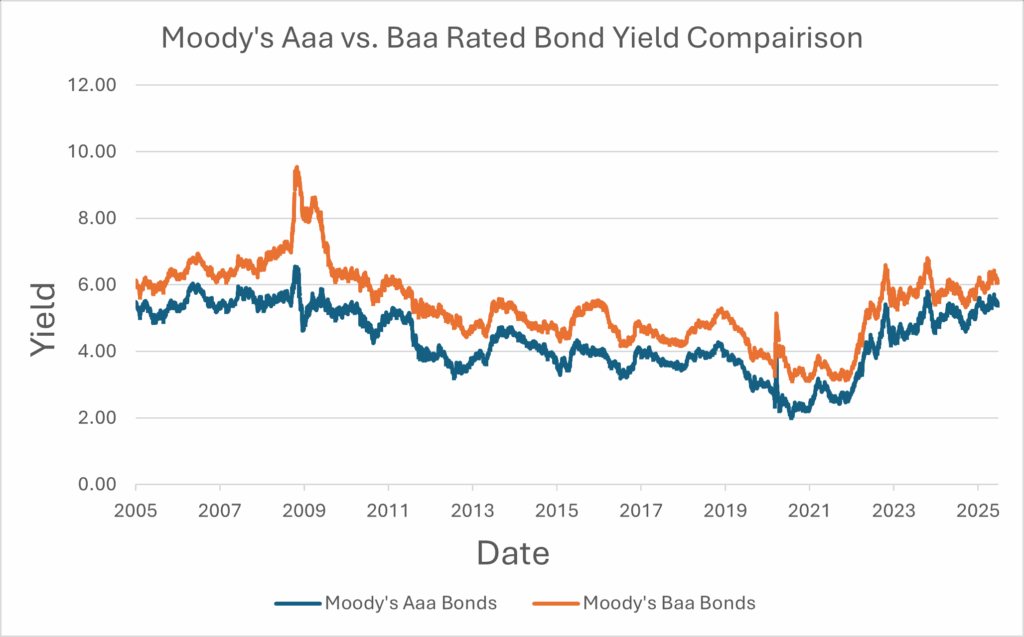

This tradeoff between risk and reward is core to bond investing. The higher the risk of default, the higher the yield typically offered to attract investors.

Chart 2: Moody’s, Moody’s Seasoned Aaa and Baa Corporate Bond Yield [DAAA] [DBAA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DAAA and https://fred.stlouisfed.org/series/DBAA, June 30, 2025

Chart 2 illustrates the yield difference between Moody’s Aaa and Baa-rated bonds over a five-year period. Riskier Baa-rated bonds consistently offer higher yields than the safer, Aaa-rated bonds. This shows the risk/reward tradeoff investors have when choosing between various bond investments.

What to Watch For: Outlooks, Fund Impact, and Ratings Limitations

In addition to a bond’s current rating, agencies also issue credit outlooks to suggest how a rating may change over the next 6 to 24 months. Outlooks can be: Positive (potential upgrade), Negative (possible downgrade), or Stable (no expected change).

While not always accurate, these outlooks often affect investor sentiment, and can move prices, well before an actual rating change happens.

Even if you don’t buy individual bonds, ratings can still impact you. Many bond ETFs and mutual funds are required to hold only investment-grade bonds. When a bond falls below that threshold, fund managers may have to sell it, even if the bond’s fundamentals haven’t changed. This can lead to price drops, fund turnover, and wider market ripple effects.

It is also worth noting that credit ratings aren’t perfect. During the 2008 financial crisis, many mortgage-backed securities rated AAA suffered large losses. This reminds us that ratings are a starting point, not a substitute for deeper research.

Example: Ford’s Downgrade to Junk

In 2020, Ford Motor Company was downgraded from investment grade (BBB-) to high yield (BB+). As a result, many institutional bond funds, restricted to investment-grade holdings, were forced to sell Ford’s bonds. That surge in selling pressure drove prices down and raised Ford’s borrowing costs going forward.

These types of bonds are often called “fallen angels,” bonds that were once investment-grade but have since been downgraded. Conversely, “rising stars” are high-yield bonds upgraded back into investment-grade territory. These transitions can create both risks and opportunities for investors.

Final Thoughts

Credit ratings offer a helpful snapshot of bond risk, and a useful tool to compare fixed income investments. Whether you’re seeking conservative income through AAA-rated bonds or looking for higher returns with high-yield bonds, understanding what these scores mean can lead to more confident investing.

If you’re unsure how credit quality fits into your broader strategy, speak with your Grimes advisor to evaluate options aligned with your income needs and risk tolerance.

This article is part of an ongoing series aimed to help build overall financial literacy, and was co-authored by Grimes & Company’s 2025 Intern Gavin Walsh. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.