With regard to negative returns, they say a bad year in bonds is about as scary as a bad day in stocks. The -4% for the Bloomberg Aggregate bond index over the first six weeks of this year is certainly challenging that notion.

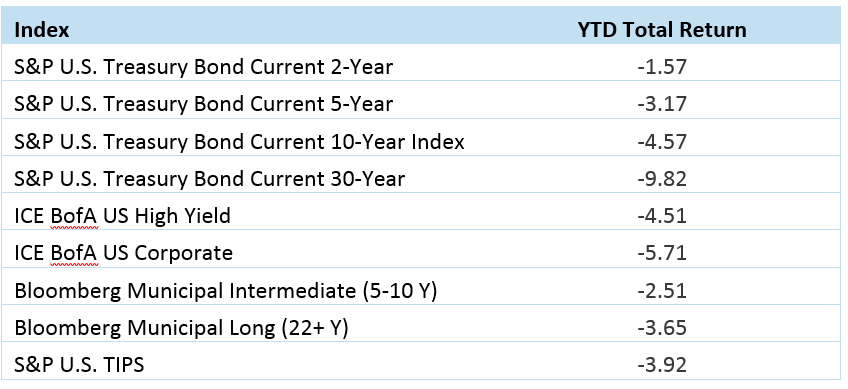

The damage is widespread across the bond spectrum, as you can see from the table of returns. Usually stocks and bonds diversify each other, but that is not the case presently. According to SentimenTrader this is only the seventh time since 1946 that both stocks and bonds declined more than 5% at the same time from a 52-week high. We all know the culprit – interest rates have risen, as inflation has started to persist and expectations for Fed tightening have shifted significantly.

(Source: FactSet)

Higher interest rates may help separate the wheat from the chaff. Companies with strong cash flow will continue to have easy access to capital and likely continue to attract investors. Long shot deals are far less likely to be funded with higher borrowing costs, and companies and projects that do not have a path so self-sustainability in the near run may face extinction. Perhaps it is a time when active investment management can really shine and outpace benchmarks.

Another recent blog post “What is the bond market telling us right now” discusses what the bond market is currently signaling. So far, persistent problematic inflation is not in the cards. A 2% 10-year Treasury yield and 3% inflation breakeven rates show that the market is not pricing in runaway inflation lasting much beyond this year at this time. Now that could certainly change, and the market adjustment would be quite uncomfortable, especially for bonds. However, the other scenario could occur as well.

Since markets move in anticipation of economic developments, even though rising inflation is the current headline, there is a fairly good chance that much of the damage to the bond market has already occurred. Expectations are for seven 25 basis point rate hikes bringing money markets to a 1.75% yield by year end, but the 2-year Treasury’s rise from 0.73% at the start of the year to about 1.60% now is anticipating much of that. If evidence arises diminishing the odds of that happening, then the shorter maturity bonds that have had a very difficult time so far this year would rally. What could cause this? Inflation could subside, allowing for slower Fed action and a soft landing. On the other side of the coin, if stocks were to crash, then the Fed might react, and bonds could rally. If the economy were to cool, bonds could rally. Really if there is anything that would entice investors to safe havens, then bonds could rally. In short, bonds could do their job and diversify stocks from these corrected levels, because they now offer a higher level of income than the start of the year, and now price a more aggressive path for Federal Reserve policy.

Important Disclosure Information:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet. Not a substitute for tax or legal advice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.