If you look across the credit spectrum this year, one picture jumps out: High yield bonds are up nicely, while publicly traded Business Development Companies (BDCs) are down hard.

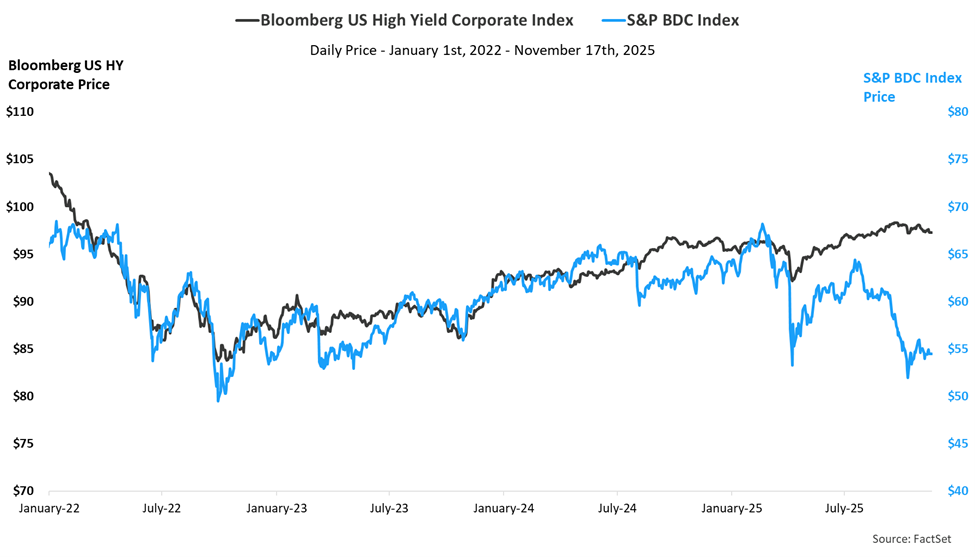

The below chart of BDCs versus high yield captures that gap clearly. A widely followed Bloomberg index of exchange-traded BDCs (CWBDC:IND) is down roughly 11–12% year-to-date and about 7–8% over the past year. Over the same period, the Bloomberg U.S. Corporate High Yield Index has delivered roughly 7–8% year-to-date, with similar one-year gains. In a world where many investors feel that “bonds are back,” BDC shareholders are living through something that looks more like an equity correction. That sets up the core dilemma: Either BDCs are correctly flagging trouble ahead in credit, or they themselves are mispriced and represent an opportunity.

Chart 1

To decode that signal, it helps to remember what BDCs actually are. BDCs lend primarily to smaller, often private middle-market businesses. By regulation, at least 70% of their assets must be in small or mid-sized U.S. companies, and they must distribute most of their income, similar to a Real Estate Investment Trust (REIT). Portfolios are usually dominated by senior secured, floating-rate loans, with some junior debt and equity co-investments. Many BDCs are publicly traded, essentially private credit portfolios in a liquid stock wrapper. Daily liquidity means share prices can swing much more than the underlying loan performance when sentiment shifts, and that volatility can occasionally create opportunity.

Right now, that sentiment is clearly pessimistic. A broad screen of listed BDCs shows many names trading 10–30% below their last reported book values, while average yields are a bit above 10%. Investors are, in effect, demanding a significant discount and a double-digit income stream to own these vehicles at a time when many other parts of the credit market are producing positive returns without that kind of headline volatility.

One bearish interpretation would be that BDCs are the canaries in the coal mine. They lend to smaller, less diversified, more levered companies, and then layer their own leverage on top. If we’re early in a more traditional default cycle, it would make sense for pressure to show up first in leveraged lenders to smaller companies. In that scenario, BDC valuations may be “right,” and the relative calm in high yield could prove too optimistic.

The alternative reading is more constructive: BDCs are being mispriced for a deep credit problem that other credit instruments are not. Credit quality still appears reasonable, as non-accruals for many rated BDCs remain below historical averages, and on a fair-value basis they sit near 1% of investments. Many large-cap platforms emphasize first-lien, senior-secured exposures and report stable or improving coverage metrics. In that view, public BDCs are simply being asked to carry a higher risk premium than other parts of the credit market, despite fundamentals that, so far, look more “late cycle” than “crisis.”

For investors, the first step is to classify BDCs correctly before reacting to the disparity. Listed BDCs behave less like core bonds and more like a hybrid of high yield, leveraged loans, and small-cap value stocks. Their distributions can be attractive, but their prices are equity-like and clearly tied to shifts in risk appetite, the path of short-term rates, and evolving views on private credit.

In our view, high-quality bonds and diversified traditional credit should continue to provide the core ballast in portfolios. BDCs, if used at all, belong in the high-risk income bucket as a satellite exposure, sized thoughtfully within a client’s overall risk budget—not as a substitute for the part of the portfolio meant to cushion equity drawdowns.

Finally, this is where process matters more than prediction. Rather than declaring that “BDCs are broken” or “BDCs are a screaming buy,” a more disciplined stance is to measure and react to the underlying credit data over time—non-accruals, recoveries, realized losses, and dividend coverage—while comparing BDC trends to what we see in syndicated loans and high yield bonds. If credit metrics deteriorate materially, the BDC market will likely have been the canary. If they remain manageable and book values broadly hold up, today’s discounts and yield differentials may prove to have been an opportunity.

At Grimes & Company, we pursue that balance through a private fund, High Income Opportunities, which targets BDCs and related high-income credit exposures and implements them with a tactical risk-management overlay, consistent with many of our other risk-managed strategies. The fund is available only to qualified purchasers who are also clients of the firm. This material is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security. Any decision to invest should be made only after reviewing the fund’s offering documents and considering whether the risks are appropriate for your individual situation.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./