How many times did President Biden say “jobs” in the first half of his address to the nation? By the sound of things, one would think it near impossible to find work during these times.

The Fed, too, is not only focused on inflation, but also employment and still sees slack in the system. Just this past week, Fed governor Lael Brainard called for patience before removing monetary accommodation. “The outlook is bright, but risks remain, and we are far from our goals,” she explained. “It will be important to remain patiently focused on achieving the maximum-employment and inflation outcomes in our guidance.”

The Nonfarm Payrolls number disappointed this past week, up only 266,000 jobs over the month, a slowing pace of improvement compared to the forecast for 975,000. With additional fiscal stimulus just passed and many parts of the economy re-opening, it seemed counterintuitive. A Wall Street Journal editorial offered several explanations, including fear of COVID, issues with childcare, and the fact that enhanced unemployment benefits significantly reduce the need/desire to get back to low paying jobs.

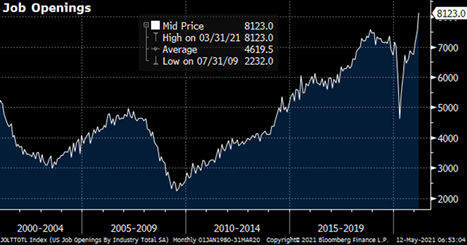

The below chart shows the job openings data from the JOLTS report. Job openings are at the highest level ever. There are currently over 8 million jobs that are not filled in America! Businesses cannot find workers. Hotels cannot find people to clean rooms. Restaurants cannot find waitstaff and kitchen help. Small businesses that somehow managed to survive a year-long closure of the global economy are simply unable get people to return to work.

Source: Bloomberg

Big corporations are paying up for new workers and will likely pass the cost on to consumers. Amazon and McDonalds are paying $1,000 signing bonuses to entry-level help to entice them to come back to work. Chipotle has increased wages to $15 per hour (which they would probably have to do soon anyway, due to pending new legislation).

Many people needed immediate and substantial help in the wake of COVID-19, as the economy shut down and jobs evaporated amid life-threatening health risks. But, now there are vaccines readily available and more job openings than at any time in history. The fiscal stimulus has managed to keep demand elevated, but has also restricted the supply of labor. Once again, rising prices are how markets correct a supply / demand imbalance.

The bottom line is simply that the more you pay people not to work, the less likely they are to look for a job. Since the boost to unemployment benefits ends in September, vaccines will be available for those in risky jobs, and the remaining restricted parts of the economy can return to normal levels, this should be a “transitory” issue, and we can get people back to work, filling the record number of open positions.

Important Disclosures:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.