You may not think about it when naming a beneficiary, but one small decision can significantly impact how your wealth is passed on. When setting up or reviewing your estate plan, consider how your assets will be distributed among your heirs. This often comes down to choosing between two legal terms: per stirpes and per capita.

While they may sound technical, understanding the difference can help ensure your wealth is passed on the way you intend—especially in the event that one or more of your beneficiaries passes away before you. Here’s what each term means, and why choosing the right one matters for your family’s inheritance.

How Per Stirpes and Per Capita Affect Your Estate

These two Latin terms define how your estate is distributed when a beneficiary dies before you. The key difference is who receives that person’s share:

- Per Stirpes (“by branch”): If a beneficiary dies before you, their share goes to their descendants (typically children or grandchildren).

- Per Capita (“by head”): If a beneficiary dies before you, their share is divided among the remaining living beneficiaries, typically at the same generational level.

Example:

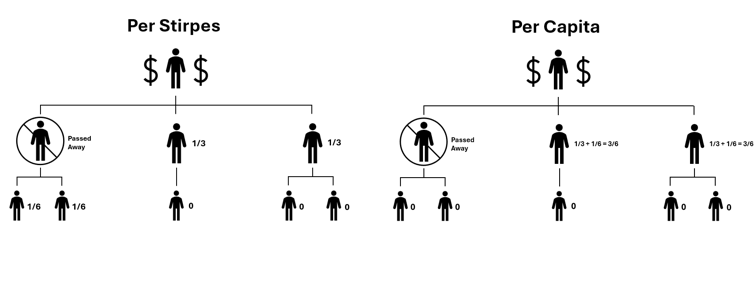

John has three children—Ben, Lauren and Ashley. If Ben dies before John:

- Under per stirpes, Ben’s one-third share goes to his children.

- Under per capita, Ben’s share is divided equally between Lauren and Ashley. Ben’s children would receive nothing.

These approaches can result in very different outcomes depending on your family structure. Here’s a visual breakdown of how each method impacts your family’s inheritance pattern:

Where This Matters

You will often be asked to select per stirpes or per capita when naming beneficiaries on:

- IRAs and 401(k)s

- Brokerage and investment accounts

- Life insurance policies

- Transfer-on-death (TOD) registrations

It is important to note these beneficiary elections take legal precedence over your will and other estate documents, so it’s essential to keep everything aligned.

Which Is Right For You?

There’s no universal right answer. Per stirpes is often preferred if you want your assets to stay within each branch of your family. Per capita may be better if you want everything divided equally among surviving beneficiaries at a specific generational level. The best choice depends on your goals, your family dynamics, and how you want your legacy to be remembered.

Beneficiary designations are easy to overlook but carry significant weight. We recommend reviewing them regularly—especially after major life events like a birth, death, or marriage—to ensure they still reflect your intentions.

Final Thoughts

The choice between per stirpes and per capita isn’t one-size-fits-all. If you are unsure how your assets would be distributed, or whether your current beneficiary designations reflect your intentions, we’re here to help.

Let’s make sure your estate plan, and every beneficiary form, works the way you intended. Our financial planning team can walk you through your options and coordinate with your estate attorney to ensure everything works together.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./