So far, nobody can complain about the communication delivered by the Federal Reserve giving early and consistent guidance as to what to expect for future policy changes.

Tapering QE to the middle of next year, and slowly raising interest rates after that, has been widely expected by the markets for quite some time. However, the Fed’s opinion that inflation will not be a long-term issue is being cast into doubt. The 6.2% year-over-year October inflation (CPI) number, released last week, came in much higher than expected, and was, in fact, the highest it’s been since 1990. Despite the sensationalism, it is too early to call a true inflation problem. That said, the Fed would be tested if inflation worsens and persists, and while they have the tools to successfully defeat the problem, using those tools would be unpleasant for markets.

Before we completely throw in the towel with the Fed’s official stance that these inflation levels are transitory, let’s take a step back and be objective. High inflation occurs when too much money is chasing too few goods – simple supply and demand. Right now, demand is off the charts for reasons we have covered in great detail in past newsletters, such as massive excess savings from the COVID lockdown and incredible amounts of fiscal stimulus. Supply of goods has been severely constrained with supply chain disruptions and major problems with global shipping logistics. This will right itself and help the inflation situation. A great example of this is that both Toyota and General Motors have stated on third quarter conference calls that their manufacturing is returning to normal levels, which bodes well for the widely reported semiconductor driven shortage. We should have cars back on car lots and not have to pay over original sticker price for a used car for much longer.

Since the surge in energy prices from oil, doubling to $80 from $40 a year ago, and the jump in car prices from this shortage account for half of the “historic” 6.2% CPI, it is notable that these increases are unlikely to continue at these rates. Oil is unlikely to double again, to $160 per barrel. Cars returning to dealer lots will cause prices to stop rising, if not decline, over the coming months.

However, some other sources of inflation may be more persistent. One is the cost of labor, which is discussed in greater detail in “Wage Inflation may last longer than you think”. So, what if inflation is more persistent, and what if the CPI numbers continue to surprise to the upside? The Fed’s two options, at the most basic level, are to either do nothing or to do something, and both would likely roil markets.

The good news is that the Fed could easily stop inflation in its tracks with their traditional tools of raising interest rates and letting their new tool (QE) disappear over time by simply not reinvesting when bonds on their balance sheet are due. The bad news is that stocks, bonds, and most assets would decline, likely substantially, in response. If the Fed even implies that rates could be raised sooner than current guidance (Q3 2022 at the earliest, post taper), then the market would need to price that in. More likely than moving sooner would be moving faster once they start raising rates, and if the Fed signals that rate hikes will be more “fast and furious” than the one to two hikes expected next year, that may not be pleasant for markets either. It is one thing for talking heads, economists, analysts, and even President Biden (who recently tweeted about inflation) to be concerned about inflation, but if the all-powerful Fed were to become worried, then we can expect volatility. That said, this is not the worst-case scenario, because it would pass and there would still be confidence that the Fed is in control and will ultimately do what needs to be done to manage the economy.

The real problem would be if the Fed does not respond to a continued inflation threat. An unwillingness to uphold their #1 mandate of managing inflation for fear of causing a market sell-off could result in a crisis of confidence in the Fed. If the Fed loses credibility, then that safety net supporting assets that we have all grown accustomed to may disappear, and in that case we can expect a larger and longer-term problem. Confidence in the Fed is what keeps the modern economy, and certainly the markets, in place.

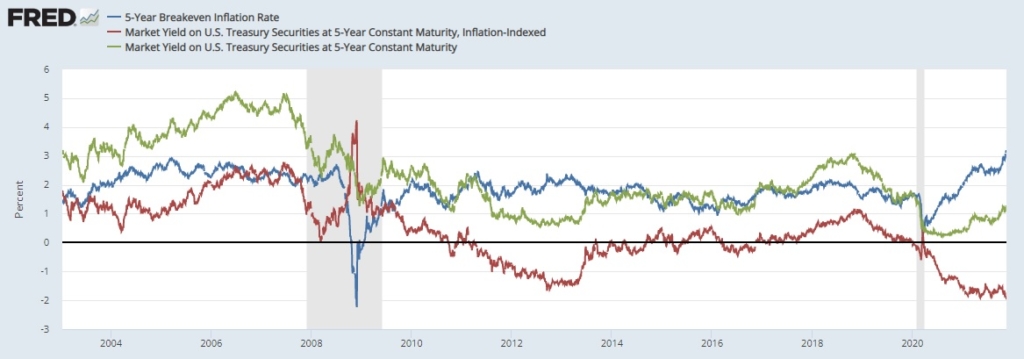

The best gauge to watch for this may be the 5-Year TIPS/Treasury breakeven inflation rate, which is the difference in yield between a 5-Year Treasury and a 5-Year Treasury inflation indexed bond. It represents what investors expect inflation to be over the next five years, on average. You can see this represented in the chart, courtesy of the St. Louis FRED website, with the breakeven inflation rate being the blue line. At 3.1%, it is the highest on record, and if this moves substantially higher it would signal that the market is losing confidence that the Fed will keep inflation under wraps and then all bets are off. At the end of the day, the Fed could always change course to move quickly if needed. Ultimately, I do not see inflation being a long-term problem, but ensuring that it is not could mean a tough period for stocks, bonds, and assets. Then again, maybe supply chains sort out, people go back to work, inflation never becomes a big problem, the Fed stays on the plan (with maybe some minor tweaks), and life goes on without much incident. After all, that is what has happened thus far.

(Source: FRED, St Louis Fed; Board of Governors)

But, by considering the risks that would come with the Fed having to abruptly accelerate its policy tightening, you can see why market participants are so jumpy. Until the current inflation surge proves itself to be transitory, data points, such as the recent CPI report, will continue to cause bouts of volatility.

Important Disclosure Information:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Board of Governors (US), NASDAQ, Bloomberg, Orion, Worldometer.info, and FactSet. Not a substitute for tax or legal advice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.