If this blog seems very familiar to you, it is. I took the framework of a blog written last week (“Framing the Big Picture”) and used the format for this application.

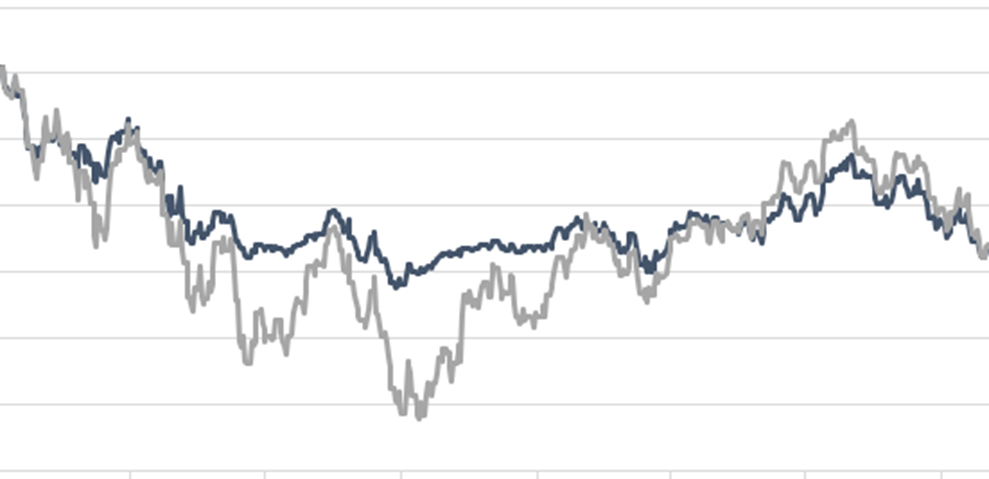

In Chart 1 below, which security would you rather have invested in?

Chart 1

I cannot speak for you, but I would have chosen the dark blue investment. It had far less volatility and drawdown than the other choice – about half the risk.

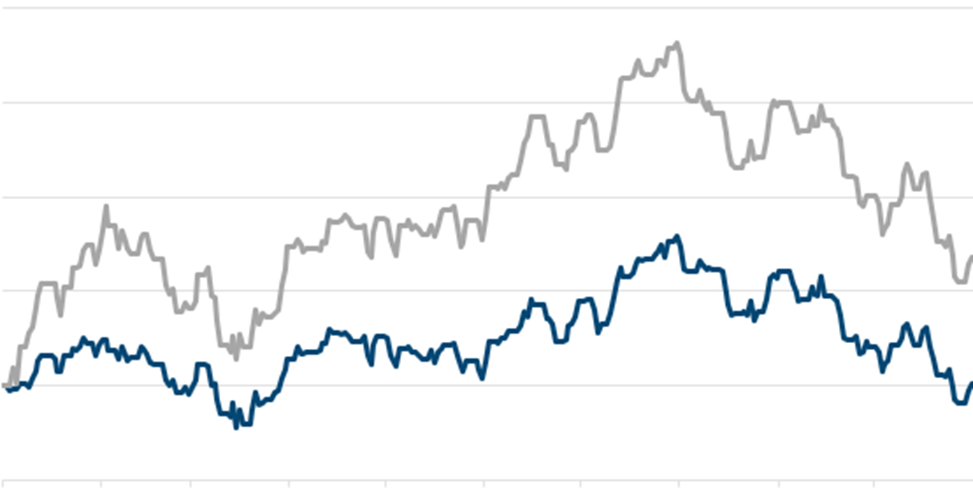

Chart 2 tells a very different story, and this time the gray investment is the clear choice, with strong returns relative to the slightly negative results for the dark blue investment. Why would anyone be satisfied with the dark blue investment? Well, what if I told you that you were looking at the same thing?

Chart 2

Time for the unveiling: the dark blue line is a global tactical investment strategy – in this case it is the model for the SectorSelect Plus strategy managed by our firm. The gray line is the return of an Exchange Traded Fund (ETF) tracking the MSCI All-Country World Index, the most widely followed global stock index. The difference is that Chart 1 is from the beginning of 2022 to present, and Chart 2 is year-to-date 2023. Chart 2 is essentially the second half of Chart 1, but with a new even starting point. So, which one is the better investment?

Spoiler alert – both are very good long-term investments. Indexing is inexpensive and will provide 100% of the upside in positive markets (like 2023) and 100% of the downside exposure in bad years (like 2022). Tactical investing means that there is flexible exposure to risk. In the case of our tactical strategies, like SectorSelect Plus depicted here, we will reduce risk and carry cash and other low risk investments during times of trouble. The downside is that we will miss parts of the recovery, which can make some time frame comparisons unattractive (like 2023), especially in the short run.

Which approach is “best” for an investor will depend on the investor’s risk tolerance and the overall allocation to risky assets, not on which strategy the investor wishes they had in hindsight for the last year. Tactical risk management can allow for an investor to have more overall stock exposure for the same expected risk than a fully invested approach. Also, risk managed strategies may make it easier to “stay the course” during the scary market periods, since the strategy reduces risk for investors so they are not temped to do so at the worst possible points (which happens in every market cycle).

For many investors the best answer may be to blend a mix of different strategy types and styles, perhaps including various bond and alternative investment approaches, together to provide the best experience for that particular investor. Reach out to your Grimes & Company Advisor to discuss in greater detail, or click here to request to speak with an Advisor.

The big loser is the investor that hops on the prior year’s big winner, only to be disappointed and frustrated – again. It is very important to assess performance over various time frames, not relying only on the most recent.

Important Disclosures:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.