When constructing a portfolio, investors face a decision about how they want their investments to be managed. There are two primary methods of portfolio construction: active and passive. These approaches vary in how portfolios are built, and they require different levels of involvement. Each has its pros and cons, and both can play an important role in your portfolio depending on your goals, preferences, and risk tolerance.

What Does Each Style Mean?

Active investing is a “hands-on” approach where investment managers or investors buy and sell securities based on research, forecasts, and market outlook. The goal is to outperform the market by owning a different set of exposures than the index it is benchmarking. Active investing is seen as particularly effective if the underlying index or sector is seen as relatively inefficient; for example, small cap or emerging market stocks with a wide range of potential holdings, or fixed income where indices are weighted towards the largest, and thus most indebted, issuers.

Passive investing takes a “set-it-and-forget-it” approach. Investors track a market index (like the S&P 500) by buying the same securities and weights as the underlying index it is benchmarking. Rather than trying to beat the market, the goal is to match its performance over time. The trade-off for the investor is that they give up the opportunity to outperform the index in exchange for eliminating the possibility of significant underperformance. While passive investing was first used in mutual funds, it has really taken off with the advent of ETFs (read our primer on mutual funds vs. ETFs here).

Planning Insight: Passive investments are more tax efficient, as holding an indexed portfolio reduces trading, and thus taxable gains. Active investing, on the other hand, will generate taxes when the portfolio is shifted and gains are taken. Of course, many active managers will work to minimize taxes and/or deliberately harvest losses to offset gains but regardless, active strategies are less tax efficient than passive strategies.

Because of this, active strategies can make sense in qualified accounts, such as 401(k)s, Roth IRAs, or 529 college savings plans. Many investors use target-date funds that shift their holdings over time with a set date. Passive strategies are often found in taxable accounts, where turnover-induced costs are minimized.

Another key difference is cost, as active management takes more time and resources.

Why Choose Either Style?

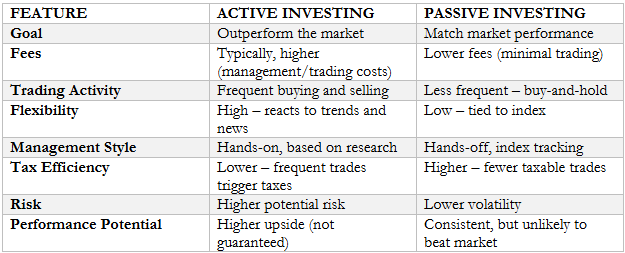

There’s no one-size-fits-all answer. Here’s a side-by-side comparison to highlight the strengths and limitations of each:

Combining Active and Passive Styles

Active and passive investing aren’t mutually exclusive. Some investors prefer passive strategies to remove emotion and avoid reacting to every market move. Others choose active management because they want more control, personalization, or potential outperformance—even if it comes with higher risk. They serve different purposes and can complement each other in a well-diversified portfolio. Your financial goals, life stage, risk tolerance, and desire for involvement all play a role.

Active and passive strategies can be combined in many ways. One is core/satellite, where a core allocation (such as large cap stocks) will be invested in a passive strategy, while satellite sectors (like emerging markets) will use active funds. Another is beta and active alpha, where a portion of the portfolio will be invested in a passive exposure to a market (known as beta), and another allocation will be made to an active fund in search of alpha (excess return over the market’s beta).

Also, there are many professional managers who use passive investments within an active strategy, opting to pair the tax efficiency and “predictable” market exposures with an overlay that can be based on a more strategic allocation model.

In all of these “hybrid active/passive” combinations, the goal is to use the strengths of both active and passive together.

The Grimes Perspective

Fees are an important factor to keep in mind, too. Typically, passive investing has lower fees because it requires less management, while active investing tends to have higher costs due to greater involvement from fund managers. Even small differences in fees can add up and have a significant impact on returns over time. Using both strategies within a portfolio can help minimize fees while still providing growth opportunities.

Wondering if your portfolio has the right balance? Talk to your Grimes advisor about whether active, passive, or a blend of both fits your long-term financial goals.

This article is part of an ongoing series aimed to help build overall financial literacy. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./