When it comes to investing, you don’t have to pick individual securities to build a solid portfolio. Mutual funds and exchange-traded funds (ETFs) are two popular ways to invest in a ready-made mix of stocks, bonds, or other assets, helping you spread your risk without the hassle of choosing each investment yourself.

While they seem similar, mutual funds and ETFs differ in how they are bought, sold, priced, and taxed. Whether you’re saving for retirement, planning a large purchase, or simply looking to grow your wealth, it’s helpful to understand how these two options compare so you can choose what’s right for you. Let’s take a closer look at how mutual funds and ETFs work, what makes them different, and how each one might fit into your investment plan.

Mutual Funds

Mutual funds aren’t traded on stock exchanges. Instead, you buy and sell them directly through the fund company, your 401(k) provider, or a brokerage (such as Fidelity, Schwab, or Vanguard etc.).

Mutual fund prices are only set once per day, after the market closes at 4 p.m. ET. The price you pay is known as the Net Asset Value (NAV), which is calculated by taking the total assets minus the liabilities and dividing it by the number of shares outstanding. Regardless of when you place your order, you’ll receive the fund’s closing price for that day.

Example:

Suppose you order $1,000 of a mutual fund at 10 a.m. when the price per share is $100. You would expect 10 shares ($1,000/$100). If the price rises to $102 by 4 p.m., you’ll receive about 9.8 shares instead ($1,000/$102).

Mutual funds are often used in workplace retirement plans like 401(k)s because they’re structured for long-term investing and offer features like automatic contributions and reinvestment of dividends.

ETFs

ETFs, or exchange-traded funds, trade on stock exchanges just like individual stocks. You can buy or sell them at any time during the trading day, and their prices change throughout the day based on supply and demand.

Unlike mutual funds, ETFs have prices that move continuously while markets are open. When you place an order, you’ll typically get the current market price at that moment.

Example:

If you buy an ETF at 10 a.m. for $100 per share and check again at 3 p.m., the price might be $101 or $98 depending on market activity.

Many investors like ETFs for their flexibility, transparency, and wide range of investment styles. They’re easy to trade through a regular brokerage account and show their holdings daily, so you always know what’s inside.

Most ETFs tend to follow passive investing strategies, such as tracking a market index like the S&P 500, but the ETF landscape has evolved over the years. Now, there are ETFs that follow smart beta or active index strategies, where the underlying index can be adjusted periodically based on specific factors like momentum or volatility. There are also more targeted ETFs, like leveraged or inverse ETFs, which aim to amplify daily returns of specific indices or move in the opposite direction of the market.

These more predictable structures are part of the reason ETFs trade throughout the day and reveal their holdings daily, offering both transparency and liquidity for investors. To learn more about passive vs. active management styles, check out our “Active vs. Passive Management Styles” article.

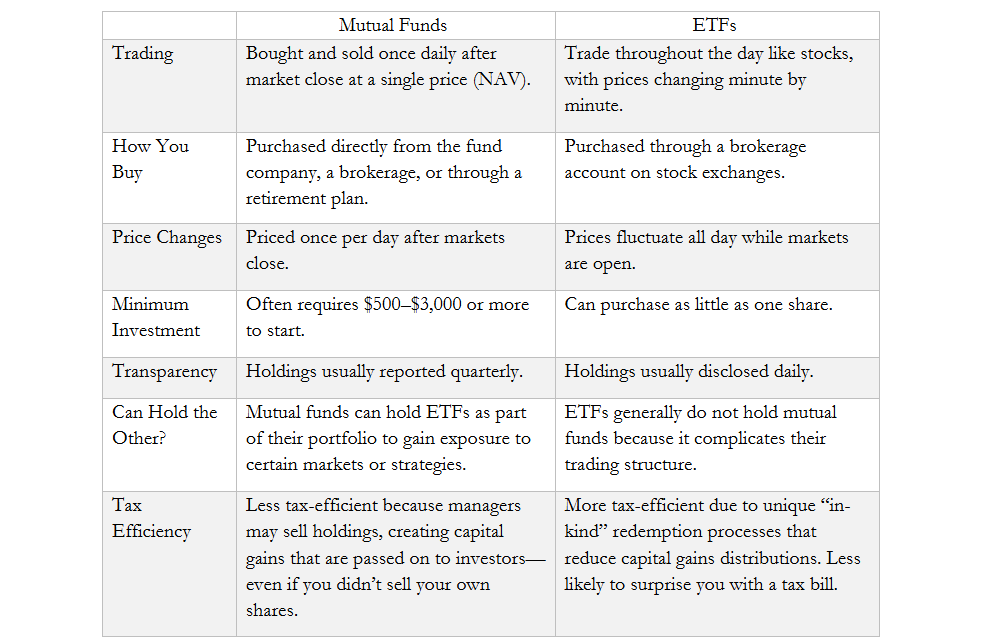

Comparing Mutual Funds and ETFs Side by Side

Mutual funds and ETFs share similarities, but they also have important differences in how they work, how you buy and sell them, and how they affect your taxes. To help make these differences clearer, here’s a side-by-side look at how mutual funds and ETFs compare:

Which One’s Right for You?

Choosing between mutual funds and ETFs depends on your investing style, goals, and how involved you want to be in managing your investments. Here’s a simple way to think about it:

Mutual funds may be better if you:

- Prefer a hands-off approach and want a professional to manage your investments.

- Are investing in a 401(k) or other workplace retirement plan, where mutual funds are often the default option.

ETFs might be better if you:

- Like the flexibility to trade during the day.

- Are investing in a taxable brokerage account and want potentially better tax efficiency.

Remember, there’s no single “right” choice—it depends on your goals, comfort level, and how hands-on you want to be. The key is choosing investments you understand and feel comfortable with.

The Grimes Perspective

Mutual funds and ETFs are both excellent ways to build a diversified portfolio without having to pick individual stocks or bonds. While one might fit your situation better, you don’t necessarily have to choose just one. Many investors use mutual funds for retirement savings and ETFs for personal brokerage accounts.

In simple terms, mutual funds are great for set-it-and-forget-it investing, while ETFs offer more flexibility and often lower costs. Both types can be held long-term and used to help you reach your financial goals. And while ETFs trade during the day, you don’t have to watch them constantly; many investors buy and hold them just like mutual funds.

One thing to keep in mind with both mutual funds and ETFs is fees. Mutual funds are typically actively managed, which often results in higher expense ratios compared to ETFs, which are usually passively managed due to their nature of tracking an index. Being mindful of how much you’re paying in fees and strategically planning the mix of mutual funds and ETFs is known as “fee budgeting.” It’s a valuable step in ensuring your investment strategy remains cost-efficient and aligned with your long-term financial goals.

If you’re not sure which is right for you or simply want help understanding how these choices fit into your bigger financial picture, talk with your Grimes financial advisor.

This article is part of an ongoing series aimed to help build overall financial literacy, and was co-authored by Grimes & Company’s Financial Planning Associate Matthew Licata. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./