This article focuses on how the One Big Beautiful Bill Act (OBBBA) affects estate planning, gifting, trusts, and multigenerational wealth strategy. It is written for families with complex financial lives—business owners, high-net-worth individuals, and multi-generational households—looking to understand the law’s implications for long-term legacy planning. Our goal is to help you use 2025’s unique planning window to your advantage, without getting lost in technical details or partisan distractions.

How OBBBA Changed the Landscape for Estate & Multigenerational Planning

While the One Big Beautiful Bill Act (OBBBA) made headlines for tax bracket changes and deduction reforms, it also quietly reshaped the financial landscape for families, parents, and grandparents. From a permanently higher estate exemption to new tools for intergenerational support, OBBBA offers powerful ways to strengthen your legacy, if you know where to look.

This article breaks down the most relevant changes for wealth transfer, gifting, and family-focused planning, so you can align your 2025 and 2026 strategy with what’s new. Read the first article in our OBBBA series here.

A Permanent Estate & Gift Exemption Baseline

For years, the federal estate and gift tax exemption has been a moving target. Under prior law, the enhanced exemption, set by the 2017 Tax Cuts and Jobs Act (TCJA), was scheduled to drop by nearly half in 2026. OBBBA removes that uncertainty.

Beginning in 2026, the federal estate, gift, and generation-skipping transfer (GST) tax exemption is permanently set at $15 million per individual (or $30 million per married couple), with inflation adjustments starting in 2027.

Planning Insight: This change locks in long-term planning flexibility for high-net-worth families. With no sunset looming, there’s less urgency to rush gifts before a deadline, but that doesn’t mean you should wait. Now is the time to implement more intentional wealth transfer strategies, such as GRATs, irrevocable trusts, or family partnerships. Freezing estate values today, while locking future appreciation outside the taxable estate, remains one of the most powerful tools in advanced planning.

State-Level Alert: This change applies only to federal estate tax. States such as Massachusetts, Oregon, and New York continue to impose their own estate taxes, often with thresholds as low as $1 million. Proactive planning is still essential at the state level.

Trump Accounts: Tax-Deferred Baby Bonds for the Next Generation

Starting in 2025, all children born between 2025 and 2028 will receive a $1,000 federal seed contribution into a new Trump Account. Families can contribute up to $5,000 per year per eligible child, with contributions growing tax-deferred. These accounts are custodial until age 18 and subject to future qualified withdrawal rules. The Treasury will begin implementation on July 4, 2026. Contributions are after-tax (non-deductible), investments are restricted to low-fee index funds, and no rollovers or Roth conversions are permitted. For example, a grandparent funding five Trump Accounts or parents coordinating Trump and 529 contributions could build a diversified long-term plan—without triggering gift reporting.

Planning Insight: While this vehicle is not a Roth IRA, it mimics tax-deferred growth with long-term benefits. Trump Accounts offer a low-maintenance, non-trust alternative for early-stage wealth transfer. This is ideal for grandparents or parents seeking to fund future education, entrepreneurship, or housing for children, without triggering lifetime exemption use or complex trust structures.

Expanded Child & Dependent Tax Benefits: Cash Flow Relief for Families

The Child Tax Credit (CTC) has long been a planning tool for middle-income families, but OBBBA significantly reshapes how it works—making it more valuable and more accessible, especially for multi-generational households. Starting in 2026, the credit increases to $2,200 per qualifying child under age 18, is fully refundable regardless of earned income level, and has higher phaseout thresholds of $400,000 for married couplies filing jointly (MFJ) and $200,000 for single filers (Single).

At the same time, the Dependent Care FSA limit increases from $5,000 to $7,500, offering a larger tax-advantaged opportunity to fund childcare. This enhanced benefit begins to phase out at $200,000 AGI for single filers and $400,000 AGI for married couples filing jointly. For families near these thresholds, pre-tax planning and AGI coordination become essential.

Planning Insight: These changes provide meaningful cash flow relief to families and grandparents supporting younger generations. Coordinating gifting strategies, Roth conversions, or employer benefit elections may help households remain under critical AGI thresholds—maximizing both the refundable Child Tax Credit and Dependent Care FSA benefit.

Tax-Free Tip and Overtime Income: A Boost for Early-Career Earners

From 2025 through 2028, OBBBA allows up to $25,000 (Single) or $50,000 (MFJ) for tips and $12,500 (Single) or $25,000 (MFJ) for overtime income to be excluded from federal income tax. The deduction begins to phase out at $150,000 MAGI (Single) and $300,000 MAGI (MFJ).

Planning Insight: The tip and overtime income exclusion is a valuable tool for younger workers or supported family members to boost their cash flow without adding to their tax burden. Because the income still qualifies as “earned,” it can be used to fund IRA or Roth IRA contributions—allowing families to match or supplement retirement savings for teens and early-career adults. It’s a tax-free way to turn short-term work into long-term wealth building.

Home Equity Interest Deduction: A Resurrected Tool for Flexible Family Lending

Before 2018, taxpayers could deduct interest on up to $100,000 of home equity debt regardless of how the funds were used. The 2017 Tax Cuts and Jobs Act (TCJA) eliminated this flexibility, allowing deductions only if the loan proceeds were used for substantial home improvements. OBBBA reverses this limitation. Starting in 2026, taxpayers may once again deduct interest on up to $100,000 in home equity debt, regardless of how the funds are used—as long as the debt is secured by a qualified residence.

Planning Insight: Families often use home equity as a bridge—helping adult children buy homes, fund businesses, or cover caregiving costs. This change reintroduces a deduction that makes those loans more tax-efficient. This is particularly helpful for clients who don’t itemize often but plan to in certain years—such as after a charitable lump gift, a medical expense spike, or a property tax prepayment.

OBBBA’s Hidden Planning Perks for Families

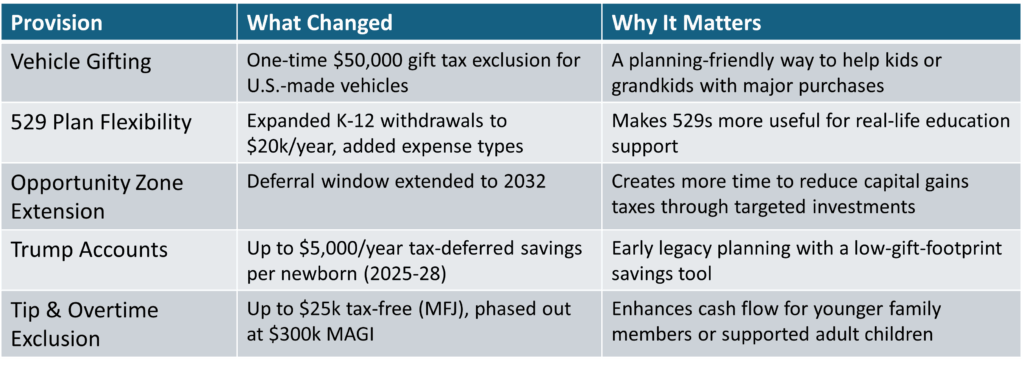

The following table is a roundup of provisions that may unlock additional opportunities for families:

Ready to Optimize Your Multigenerational Strategy?

The OBBBA opens new doors for estate planning, gifting, and family wealth transfer—but the best opportunities depend on timing and coordination. As 2025 and 2026 approach, now is the time to revisit your trust structures, gifting plans, and family cash flow strategies.

- Are you maximizing the permanent $15M exemption?

- Could Trump Accounts or expanded FSAs benefit your children or grandchildren?

- Is your AGI positioned to take advantage of deductions and credits?

- Are you balancing state-level estate taxes with federal exemptions?

Review your plan with your financial advisor, CPA, and estate attorney to ensure it reflects the new law and your family’s evolving goals. If you’d like a second set of eyes or want to explore updated strategies, schedule a conversation with your Grimes advisor.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./