Bonds are one of the building blocks of a well-diversified portfolio. Among the most common types are Treasuries, municipal bonds, and corporate bonds. Each comes with its own blend of benefits, risks, and tax treatments. Understanding these differences can help you choose the right fixed income investments for your goals.

(New to bonds? Start with our introductory article here.)

Treasuries

Treasuries are issued by the federal government and backed by its full faith and credit, making them the safest type of bond from an issuer perspective. They generally offer lower yields than other bond types but provide high liquidity and virtually no default risk. Treasuries, especially those with short-term maturity, are ideal for conservative investors focused on capital preservation, particularly during periods of market volatility.

From a tax standpoint, Treasuries are federally taxed but exempt from state and local taxes, an advantage for investors in high-tax states.

Municipal Bonds

Municipal bonds are issued by state and local governments to finance public projects such as roads, schools, and water systems. While generally low risk, especially when backed by tax revenues, they carry slightly more credit and liquidity risk than Treasuries.

A major benefit is that municipal bond interest is typically exempt from federal income tax, and in many cases, also from state and local taxes if you live in the issuing state. Because of these tax advantages, a municipal bond with a lower yield may provide more after-tax income than a higher-yielding corporate bond that’s fully taxable, depending on your tax bracket. For investors in higher tax brackets, understanding this idea of tax-equivalent yield can help you compare the after-tax income of municipal bonds against taxable alternatives on a level playing field. These tax advantages make them attractive to investors seeking tax-efficient income.

Corporate Bonds

Corporate bonds are issued by public and private companies to raise capital for operations, expansion, or refinancing debt. Because companies have varying financial health, some corporate bonds carry higher default risk relative to Treasuries but also offer higher yields in return.

Interest from corporate bonds is fully taxable at the federal, state, and local levels. Like municipal bonds, these bonds may include call provisions, allowing the issuer to repay early, which can impact long-term income expectations. Corporate bonds may appeal to investors looking for greater income potential and willing to accept more risk.

Risks That Apply to All Bonds

In addition to issuer-specific differences, all bonds share a few key risks:

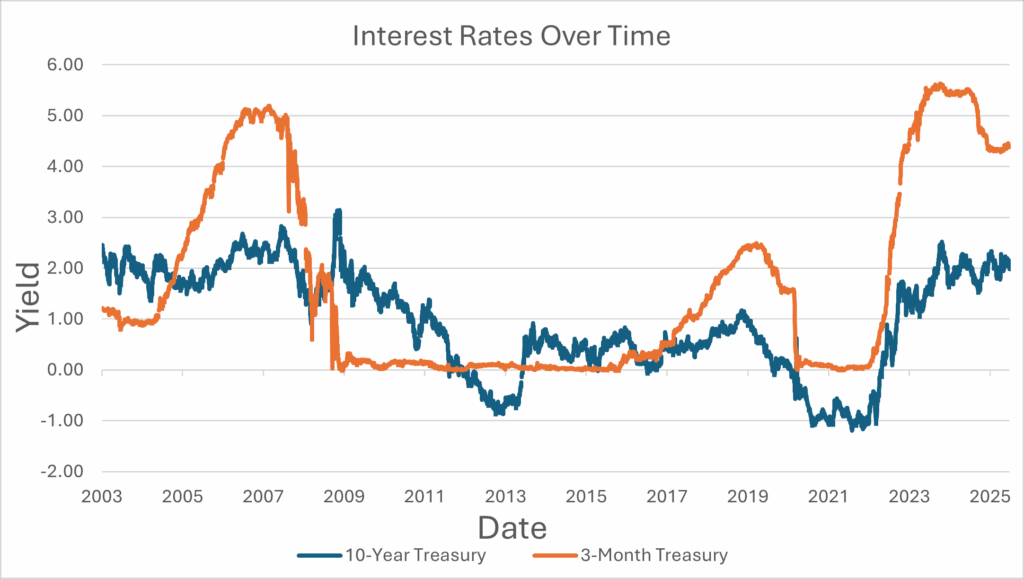

Interest rate risk: Bond prices typically fall when interest rates rise. This is more pronounced in longer-term or high-duration1 bonds. Chart 1 below demonstrates that the long-term 10-year Treasury bill is more sensitive to interest rate changes than the short-term 1-month Treasury bill.

Call risk: Some municipal and corporate bonds may be repaid early by the issuer, reducing your expected income.

Liquidity risk: Treasuries are extremely liquid, while certain municipal and corporate bonds may be harder to sell without affecting the price.

Chart 1: Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed [DFII10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFII10, June 30, 2025.

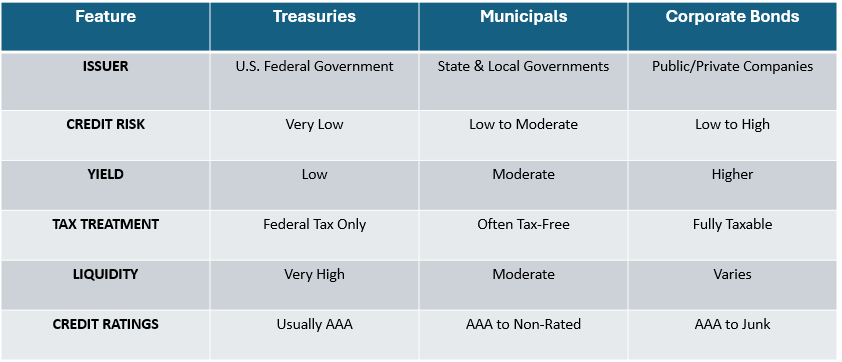

How These Bonds Compare

Not sure which bond is right for you? Here’s a side-by-side comparison of Treasuries, municipal bonds, and corporate bonds. This snapshot can help you quickly assess which type may best align with your goals, tax situation, and risk tolerance:

Chart 2

Final Thoughts

Each bond type offers distinct trade-offs based on your goals, risk tolerance, and tax situation. Treasuries provide unmatched safety, municipals deliver tax-advantaged income, and corporates offer the potential for greater returns in exchange for increased risk. In many cases, a well-balanced and diversified portfolio including all three bond types can help balance risk while still generating income and benefiting from tax advantages.

Not sure which bond type fits your portfolio best? A quick chat with your Grimes financial advisor can go a long way toward aligning your fixed income strategy with your goals.

This article is part of an ongoing series aimed to help build overall financial literacy, and was co-authored by Grimes & Company’s 2025 Intern Gavin Walsh. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

- Duration – a way to measure the interest rate risk and the sensitivity of a bond. Duration is a critical factor in fixed income investing and helps investors understand and manage interest rate risk. ↩︎