When you buy a stock, you’re not just buying a symbol on a screen — you’re becoming a part-owner of a real business. As a shareholder, you own a piece of that company, which can entitle you to a share of its profits, a say in major decisions, and the opportunity to grow your wealth over time. This is known as equity ownership — your money in exchange for a share of a company. That capital helps the company grow and innovate, and in return, shareholders get a stake in its success.

This is why stock investing can be a powerful wealth-building tool. Investors benefit not only from a company’s current performance, but also from long-term compounding over time.

Shareholder Rights and Benefits

Owning stock gives you a financial stake in the company, and possibly a voice in its future. Most common stocks come with voting rights, which give shareholders a say in important matters like board elections and company policies. The right to vote shows that shareholders are more than just spectators — they’re participants.

Example: In 2024, Tesla shareholders voted on a multi-billion-dollar compensation package for Elon Musk — showing how shareholder votes can impact company decisions.

While individual investors rarely sway outcomes on their own, collective shareholder voting can still influence a company’s direction. More importantly, the requirement that all shares be treated equally on governance measures means each share will trade with this right, even if the individual investor’s holding is small.

Shareholders may also benefit through capital appreciation. One thing to be aware of is the tax implications that capital appreciation is subject to, which vary depending on whether the gain is short-term (held one year or less) or long-term (held longer than a year). (Learn more in our post on capital gains and taxes.) Combining capital appreciation and corporate governance, another driver of stock value is acquisition. Whether actual or perceived, the fact that acquiring control of a company requires all shares to get the same offer, means markets are always thinking of what an acquirer would pay for a stock.

In addition to price gains, some companies also pay dividends, regular cash payments to shareholders from company profits. These can provide income in addition to stock growth.

Why Do Stock Prices Fluctuate?

Before we dive into what causes prices to rise and fall, it’s helpful to understand how stock prices are set in the first place. Stock prices change often — sometimes by the minute. While it may seem unpredictable, prices generally reflect what investors are willing to pay based on future expectations.

At its most basic, stock prices move based on supply and demand. If there are more buyers than sellers, prices go up. If there are more sellers than buyers, prices go down.

Prices don’t always follow logic in the short term, but over time, they tend to reflect the company’s strength and trajectory. To understand this more deeply, it helps to explore the major forces that cause price fluctuations.

They are driven by three key factors: company performance, macroeconomic events, and investor sentiment.

Company-Specific News

Public companies report financial results every few months. When those results beat expectations, stock prices often rise. When results disappoint, prices fall. A company might report record-high profits, but if those results are lower than expected, the stock could still fall. Because prices can move sharply on company-specific news, it’s smart to own a diversified portfolio across industries to spread risk and smooth out volatility.

Macroeconomic Causes

Market-wide events like interest rate changes, recessions, inflation, or global disruptions (e.g., COVID-19) affect all stocks.

For example, the Federal Reserve uses interest rates to manage the economy. Rising rates means more expensive borrowing, slower growth, and falling stock prices. On the other hand, lower rates mean easier borrowing, more spending, and rising stock prices. Therefore, when the Fed makes an announcement, all stocks will react at the same time.

Because macroeconomic factors can cause all stocks to move at once (though the impact may vary by company), we diversify equity holdings across multiple sectors (International, Emerging Markets, Small Cap) as well as diversify our stocks holdings with fixed income and alternatives, based on client needs.

Investor Sentiment

Sometimes, prices move simply because of how investors feel. Headlines, social media, and financial news all influence sentiment. When investors feel confident, they buy — pushing prices up. When they’re uncertain, they sell — pushing prices down. Sentiment often changes quickly, sometimes before the actual data does. While sentiment shifts are often driven by company-specific or macroeconomic factors, it is important to understand that they can exaggerate the short-term price movements.

Why This All Matters

At this point, you’ve learned what it means to be a shareholder and some factors that cause stock prices to fluctuate. When you understand what you own and why prices move, it becomes easier to stay grounded, even when markets get noisy.

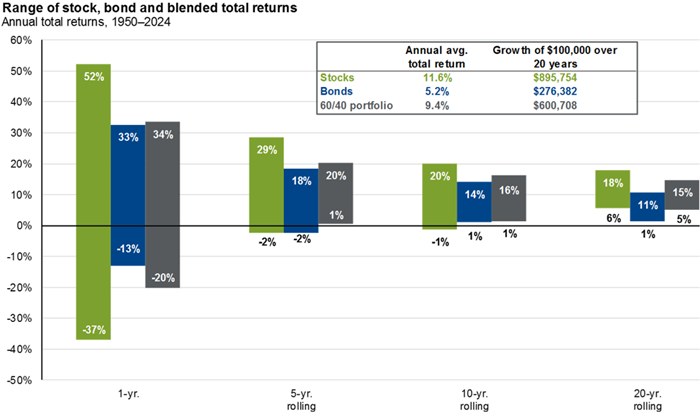

Chart 1 (Source: JP Morgan):

The longer you hold stocks, the more predictable your returns become. Historical data shows that one-year returns can vary dramatically, while 10- and 20-year returns tend to smooth out — a powerful reason to stay invested.

Don’t let short-term moves distract you. Stick to your plan. Remember, investing is a long-term journey, and ownership can be one of the most powerful tools to help you build lasting wealth. As Chart 1 illustrates, while stock prices can be volatile in the short term, the ups and downs even out over time. Risk – as measured by the range of returns – falls, while the average annual return stays steady.

This article is part of an ongoing series aimed to help build overall financial literacy. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.////