One area many investors overlook is how investment gains are taxed. While focusing heavily on returns, they often neglect to consider how much of those gains they keep after taxes. This is where understanding the difference between short-term and long-term capital gains becomes essential. Not only can this knowledge help you optimize your investment strategy, but it can also significantly reduce your tax bill over time.

The basics: What are Capital Gains?

A capital gain occurs when you sell an asset (like stocks, bonds, real estate, or other investments) for more than you paid for it. The gain is the difference between your purchase price (basis) and your sale price. However, that gain is not taxed the same way in all situations. The IRS divides capital gains into two categories based on how long you’ve held the asset.

Short-term Capital Gains

Short-term capital gains refer to assets sold within one year or less of being purchased. These gains are taxed at ordinary income tax rates, meaning they could be taxed similarly to wages, salary, or business income (which can be as high as 37% at the federal level depending on your income).

Example: Buy a stock and it grows by $10,000 in value, subsequently selling within 12 months, that gain could be taxed at 35%, leaving you with $3,500 of federal taxes.

Long-Term Capital Gains

Long-term capital gains apply to assets held for more than one year before being sold. These gains benefit from preferential tax treatment and are taxed at lower capital gains rates—either 0%, 15%, or 20%—depending on your taxable income and filing status (refer to income tables here).

Example (continued): If you wait to sell after holding the stock for over 12 months, you might only pay 15%, leaving you with $1,500 of federal taxes. That’s a $2,000 difference, simply due to timing.

How Do They Work Together?

Most people end up with a mix of both short-term and long-term gains (and losses) throughout the year. First, your short-term gains and losses are netted against one another, and the same is done for your long-term positions. Then, if one group ends up with a net loss and the other with a gain, they are offset against each other.

Example: If you have $10,000 in short-term gains and $6,000 in long-term losses, your net taxable gain would be $4,000 of short-term gain—which would be taxed at the higher ordinary income rates.

In cases where your losses exceed your gains for the year, you can deduct up to $3,000 of that net capital loss against other types of income, such as wages or interest. Any remaining unused losses can be carried forward indefinitely to offset gains in future years.

transitioning a taxable account

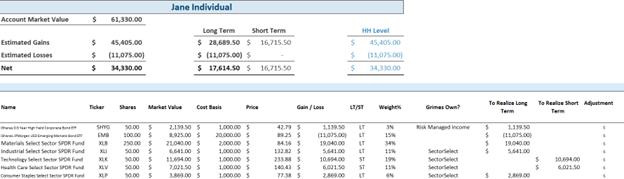

Being intentional about when you sell investments is just as important as choosing the right investments at the outset. When transitioning a taxable brokerage investment account – whether to Grimes & Company, another advisor, or self-directing – it is extremely important to take taxes into account when making changes. At Grimes & Company, we specifically look at your holdings and generate a proposal based on your customized asset allocation and investment strategy. On top of this analysis, we work with your CPA and review your tax return to project out your liability based on the transition, as seen in Chart 1.

Chart 1

Turn Losses Into Tax Savings: The Power of Tax-Loss Harvesting

Tax-loss harvesting is a strategy where you sell underperforming assets to offset gains from winning ones, reducing your overall tax bill. While many investors wait until year-end, it pays to track your portfolio throughout the year for loss-harvesting opportunities. Just beware of the “wash sale” rule: If you repurchase the same or a similar investment within 30 days, your loss won’t count for tax purposes.

Tax-loss harvesting is especially useful if you’re rebalancing your portfolio, trying to lower your taxable income, or managing gains after a strong year. Ultimately, this strategy helps you make the most of your portfolio.

Tax loss harvesting isn’t about timing the market or making emotional decisions, it’s about being smart and intentional with what the market gives you. If you’re unsure how to position your portfolio or when to realize gains, working with your Grimes financial advisor can help you create a tax-aware investment strategy tailored to your goals. A well-designed plan doesn’t just aim to grow your wealth—it helps you keep more of it.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.///