Not all stocks behave the same or serve the same role in your portfolio. Two of the most common investing styles are growth and value. While both aim to generate returns, they take different paths to get there. Growth stocks focus on future potential. Value stocks lean on current fundamentals. By understanding how each behaves, you can build a more balanced investment strategy.

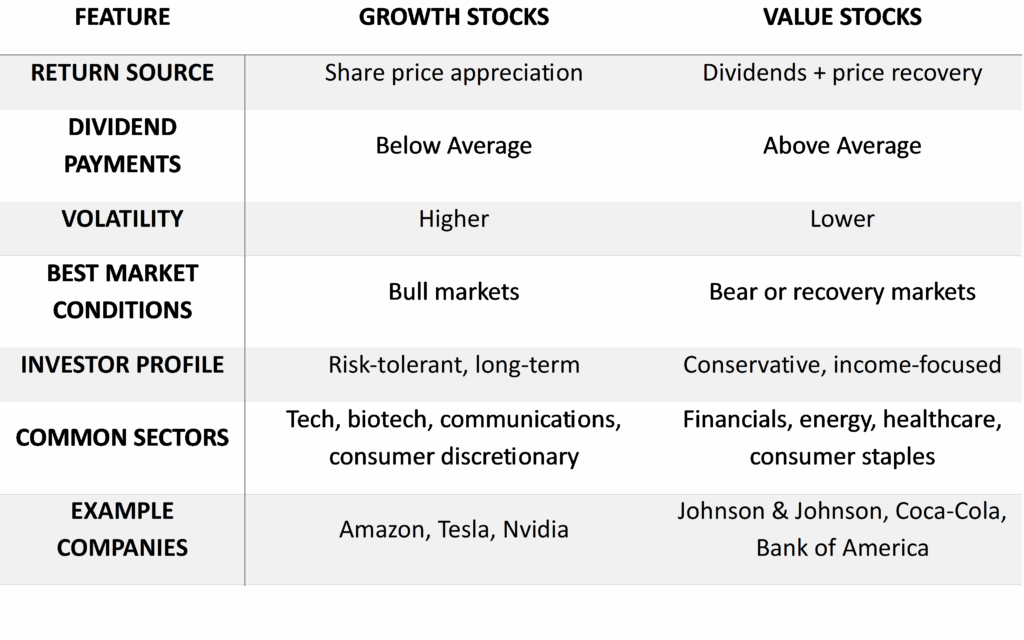

Characteristics of Growth vs. Value Stocks

Growth stocks represent companies expected to increase earnings faster than the market average. These businesses, often in sectors like technology, biotech, or communications, reinvest profits to fuel internal innovation and expansion, and thus pay lower than average dividends. Instead, investors in growth stocks rely on capital appreciation, the expectation that stock prices will rise as the company’s potential becomes reality.

Growth stocks often perform well during bull markets, when the economy is expanding, interest rates are low, and investor confidence is high. They outperformed significantly during the 2010s tech boom but can experience sharp pullbacks when earnings disappoint or rates rise.

Value stocks, by contrast, represent companies that appear undervalued based on financial metrics like price-to-earnings (P/E) or price-to-book (P/B) ratios. These are typically mature businesses with predictable earnings and dividend payments, offering income while investors wait for prices to recover.

Chart 1: A quick side-by-side view to summarize the key differences between Growth and Value Stocks

Value stocks tend to hold up better during bear markets, inflationary periods, or economic uncertainty. Their lower valuations and dividend yields can act as a buffer during market volatility, as seen in the early 2020s when value stocks outpaced growth.

Growth vs. Value Stocks in Action

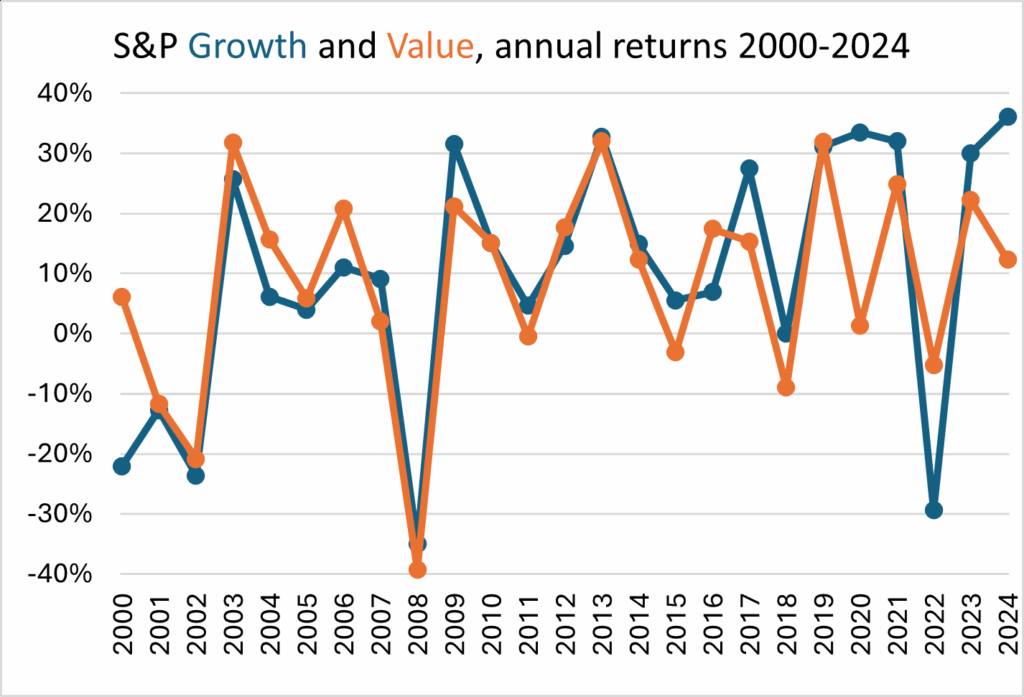

Growth and value stocks can rotate in and out of favor. For example, in 2020 and 2021, growth outperformed value, which was then followed by value outperforming growth in 2022. Growth stocks have outperformed value in seven out of the last 10 years. This might lead one to believe they are all you need in a portfolio.

However, as Chart 2 demonstrates, things have been more even when taking a broader view and going back to 2000, with 13 growth years and 12 value years (although note value’s seven straight years of outperformance from 2000 to 2006). Over this entire period, the two have been similar, with a 10% return for growth and 9% for value, and an identical standard deviation of 16%.

Chart 2

What Are the Risks?

For value stocks, the risk is that the negative sentiment that has resulted in a stock having a lower-than-average valuation is reinforced by subsequent bad news, and the stock continues to languish. In other words, bads news is followed by more bad news. This is known as a value trap. The main issue is that a market trend sustains itself longer than an investor thinks.

For growth stocks, the risk is that good news creates high growth expectations that generate lofty valuations. These high expectations set the table for subsequent disappointment as results, though good, may not be quite as good as hoped. The issue is that the market trend does not last as long as expected.

Taking a step back, the risk of value stocks is that market trends last longer than expected, while the risk of growth stocks is that the market trends do not last as long as hoped. Inasmuch as market trends can be common across stocks, the two investment styles can balance each other in their risks, too.

Final Thoughts: Investors Can Use Both for Diversification

Growth and value aren’t opposites, they’re complements. Growth looks to the future; value leans on fundamentals today. Each style brings different strengths, and both have a place in a diversified portfolio. Rather than choosing one style over the other, most investors benefit from holding a mix of both. Holding both styles in your portfolio can:

- Reduce dependence on any one sector or trend

- Smooth returns across different economic cycles

- Provide a balance of long-term upside and short-term stability

A diversified approach blends the high-growth potential of certain sectors with the resilience and income of others. For instance, growth may lead during economic expansion, but value often helps stabilize returns in downturns. Since market leadership often rotates, a blended approach enhances stability.

Are you wondering if your portfolio leans too heavily toward one style? Want to see how your portfolio is positioned across growth and value? A Grimes advisor can help you evaluate your current allocation, identify style tilts, and keep your plan on track across changing market cycles.

This article is part of an ongoing series aimed to help build overall financial literacy, and was co-authored by Grimes & Company’s 2025 Intern Gavin Walsh. While not a comprehensive deep dive into every single topic, it is designed to provide a helpful overview to key topics within the world of investing and financial planning. Please reach out to connect with an advisor or expert on the subject to learn more and start planning for your financial future.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company Wealth Management, LLC (d/b/a Grimes & Company), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian./